Evan Soltas recently turned heads with a claim that the finance sector takes home half of all business profits in the United States. It turns out that this is an overestimate; in fact, the number is somewhere around 30%. But the basic story is correct. Finance, which accounts for only about 8% of GDP, reaps about a third of all profits.

Here's a graph of finance's profit share, from The Big Picture:

Those numbers are from the NIPA accounts. Here's a more smoothed version of that time series, courtesy of The Baseline Scenario:

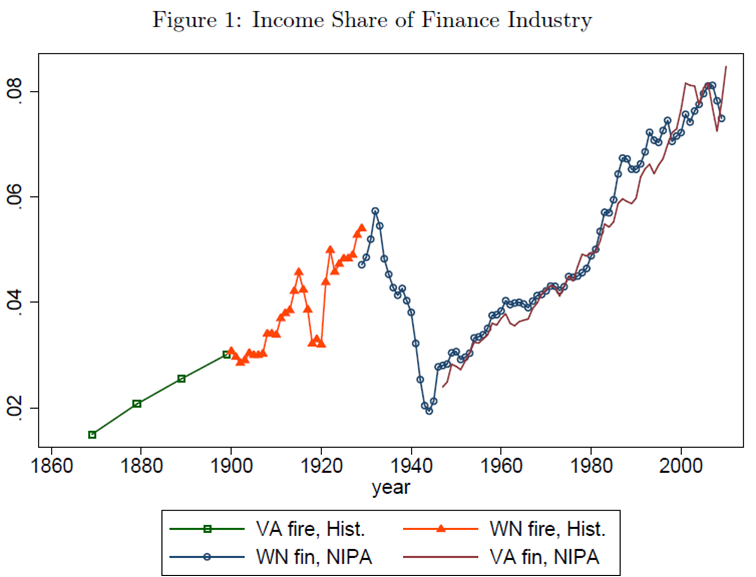

Now here, from Thomas Philippon, is a graph of the finance's GDP share:

As you can see, finance basically doubled both its GDP share and its profit share since the big deregulation of the early 1980s. And during the finance boom of the 00s, the sector reached truly dizzying heights.

BUT, take a look at those graphs, and you notice something else. Finance hasn't just captured an outsized share of profits since 1980; it has done so all the way back to World War 2.

In the 1940s and 50s, finance accounted for about 3% of GDP, and raked in about 8-15% of profits. In the 1960s and 70s, finance accounted for about 4% of GDP, and raked in about 10-17% of profits. In other words, finance has always been much more profitable than other sectors of the economy. We can blame financial deregulation (and other post-1980 factors like technology and globalization?) for the increase in finance's size, and some of the increase in its profitability, but not for all of the difference between the two.

Now, the question becomes: Why is finance so profitable? One possibility is socialization of risk: in other words, the government implictly guarantees that big banks won't fail, which allows banks to make profit in good times and shift losses onto the taxpayer when things go bad. This is not the same thing as explicit guarantees like the FDIC, which keep lending rates very low and hence squeeze bank profits. It's also not quite the same as Too Big to Fail (though TBTF is part of it); even if all banks were small, the government would bail out the system as a whole if a large enough percentage of the small banks started to fail.

Another possibility is that finance is a natural monopoly. This is weird, since finance has few network effects like Facebook or Google, and doesn't require exclusive local land access like a public utility. But in economics, any industry where economies of scale are large will gain monopoly power, and hence high profits. And banks may benefit a lot from economies of scale.

Why? My intuition says that it's part of the definition of what a bank is. A bank - or any financial institution that acts like a bank, which is most of them - makes its profits by borrowing short and lending long, and this makes it fundamentally vulnerable to a bank run (See the Diamond-Dybvig model for a formal economic model of this).

Now here's the question: All else equal, are bigger banks less vulnerable to runs? A run happens when a critical mass of a bank's creditors demand their money back at the same time. This requires some sort of coordination (which may be provided by a global game, an information cascade, a coordinating signal, some sort of sunspot equilibrium, etc.). The bigger a bank is, the more creditors (depositors, overnight lenders, etc.) it is likely to have. The more creditors a bank has, the harder it may be for a critical percentage of them to coordinate and cause a bank run.

So this might provide financial firms - which almost all act like banks - with significant economies of scale, and hence monopoly profits. But that's just my own conjecture; it may be completely wrong, and even if it's basically right, there may be other important reasons for finance's outsized profit share.

But the point is, finance has always been more profitable than other sectors, even under heavy pre-1980 regulation. This is a puzzle that needs solving.

I guess leverage solves the puzzle, also making fails in the financial sector more spetacular than in other industries...

ReplyDeleteFinance sucks. Strangle the damn sector w/ regulations. It's no good for NOTHING.

ReplyDeleteEconomies of scale in the form of moral hazard?

ReplyDeleteNot saying that big banks are bad, I think there are a lot of net-plusses OWS ignores – but the last five years clearly demonstrated the direct socialization of risk, which lends itself to large, highly leveraged, entities.

Hey Noah, This is a good post and a great conversation to begin. And thanks for catching the mistake in the original graph. I'll probably do more on this topic next week, but in case you didn't see this post with some more follow-up graphs: http://esoltas.blogspot.com/2013/02/5-more-graphs-on-finance.html.

ReplyDeleteWas trying to post this link on your blog, but not working for me, odd reason. Anyway, check out "If Financial Market Competition is so Intense, Why are Financial Firm Profits so High?

DeleteReflections on the Current ‘Golden Age’ of Finance" @ http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_101-150/WP134.pdf

There are quite a few very interesting graphs through 2007 at the end of the paper, you might enjoy.

I did see that! Thanks, Evan!

DeleteI think Ashok Rao is basically correct - The thing is, competition between banks is intense... but they do not compete on price!

DeleteThere's also the fact that a lot of banks in western countries are still operating within a national framework. Even if I go to the French HSBC (ex-CCF), I will NOT get the kind of LTV I could get in the UK or US on my mortgage. Why? God knows.

But, yeah, banks don't compete on price much and they enjoy oligopoly power in their national bases.

Plus all the things you mentioned and leverage. Good business, if you can get in on the act...

The obvious angle of attack is the expense side rather than the revenue side. Financial companies, unlike companies that produce goods or services, don't have to have much by way of physical assets or even personnel compared to the amount of money they manage. For instance, a financial firm can manage a $1 billion fund out of a small office, while in a manufacturing firm that $1 billion represents a plant that has to be maintained, and in a service firm that same $1 billion represents facilities and salaries for 10,000 employees.

ReplyDeleteAnd hence why gross operating suprlus, which also accounts for consumption of fixed capital, is probably a better series than profit.

DeleteWhy wouldn't competition drive profits down to levels similar to the rest of the economy? That's the question.

DeleteAs a lawyer with 35 years of experience in and around banking I would attribute the "success" of finance to an entirely different reason and that is that the laws do not adequately protect people with capital.

ReplyDeleteGoldman Sachs is in the arbitrage business but it doesn't make its money on the long/short game. It makes it money by having more information than anyone else can acquire and, in effect, plays off both sides to its profit.

But, don't take my word. Look for the Michael Lewis interview where he confesses that he wrote Liar's Poker with the expectation that he had so effectively exposed why no one should do business with Wall Street that he thought all the firms would fail due to customer revolt and that he was stunned that, instead, the book became an instruction manual or text, used by thousands to go to

Wall Street and continue to profit.

Larger banks were actively encouraged in the UK because they were believed to be safer. From a report into UK bank failures and deposit insurance by the Bank of England, 1996:

ReplyDelete"Another relevant factor, but one which is not highlighted, is size. All banks are affected by macroeconomic conditions. But smaller less-diversified banks do appear — not surprisingly — to be generally more vulnerable to changes in market conditions than large banks which are diversified across a number of sectors and income sources."

http://www.bankofengland.co.uk/publications/Documents/fsr/1996/art7(Issue%201).pdf

Recently, the Bank of England has been attempting to price the implicit subsidy given to TBTF banks. I think that subsidy should be taken into account when considering the profitability of banks.

In Canada in 1985 two small banks with regionally concentrated loan portfolios of relatively new loans failed while the big banks with regionally diversified loans carried on.

DeleteI suspect that information is important in explaining why finance could be a natural monopoly. There are large fixed costs to gathering information and proportionately smaller marginal costs. There are also likely synergies with increasing amounts of information. Hence large financial firms develop.

ReplyDeleteThe financial firms then profit through this information both directly through trading and also indirectly through services like M&A advisory and underwriting (relying upon their network of contacts and market knowledge).

If you count bonuses as profits, 50% might be close.

ReplyDeleteI'm inclined to think, by the way that banks are not profitable because their margins have increased, they are more profitable because they (net) own more and so are extracting bigger rents. I can't justify this - by my guess is someone can. You take a loan from the bank - it creates money and then receives an equity (or share thereof) in whatever you buy. Sure that increased equity matched by a liability somewhere else (a deposit), but the liability gives a lower return than the asset. So a general increase in leverage translates into increased bank profits because they are getting a margin on a larger share of total assets.

ReplyDeleteI don't think Monopoly is the answer. You have to torture the definition of Monopoly to construe a whole sector as Monopolistic.

ReplyDeleteDoesn't the answer lie in productivity? If you want to add output in any other sector you need to increase the number of people. However, one person in a bank can make a theoretical infinite amount. One loan officer making a loan has no theoretical limit on the size of the individual loan he can underwrite. This also would suggest that you would see loans per GDP growing over time - which indeed you do. In fact, I suspect that Finance profit share is directly tied to Debt/GDP. In other words, countries with higher debt to GDP levels would have Higher profit share of profits going to finance - there's your testable prediction.

In any case, all you need to do to capture more profits is to have a relative advantage, can one person working in finance scale his activity better than one person working in another sector?

This is close to the argument about Monopoly - but different...

One way to test your Monopoly theory would be to go back and look at the granddaddy of all monopolies and see if Standard Oil captured 30% of profits back in the day. Microsoft is probably the next largest Monopoly and I doubt they ever captured even 30% of tech profits but don't know.

I agree with you that the reg changes in the 80s are an interesting issue, but do not relate to this question. First of all profit share had doubled after WWII as well as doubling after 1980 (round numbers). More interestingly, I doubt any other industry would capture that kind of profit share regardless of regulatory changes. reg changes would more likely allow a company to capture I high share of sector profits rather than change the sector share of overall profits. There is something interesting about Finance that it has the ability to increase profit share in many different environments. I am skeptical that ROEs explain your question because profit share remained high post Lehman when leverage and ROEs collapsed.

You do realise of course that competition drives down price to equal marginal cost. Unless you are saying that bank clerks are so incredible highly skilled that only the very elite can do the job - high productivity should mean low marginal cost.

DeleteYes, haven't you just repeated Noah's question? In general that is true. It may be true even with finance over time. However, in this short period of Post WWII it seems that hasn't happened. The question is why.

DeleteLet's say in this case the spread and fees earned on lending for a loan of $1,000 is equal to the MC and is paid as a percent of the loan. All that has to happen is the loan size has to increase faster than fees in percentage terms fall, and the absolute amount earned will be in excess of MC. If the size of the loan is growing faster than GDP well, voila you have Finance capturing increasing profits.

This is very close to the Monopoly proposal as it effectively represents increasing returns to scale - just without the Monopoly.

Dan - now it seems you are repeating my argument from the post above.

DeletePerhaps, I suppose the other point is just that there isn't always competition. Emmanuel Saez has done great work on 'inequality' and its a similar question to this one. Why does a small percent of the population earn a high percent of incomes.

DeleteSaez notes rather dryly that:

"If we define rent in terms of situations where pay doesn’t correspond to what economists call ‘marginal productivity’—that is, the economic contribution a person is providing—I would say yes, because the evolution of income concentration over time and across countries has a number of features that are inconsistent with the story where pay is everywhere equal to productivity."

It doesn't seem like such a stretch to conjecture that finance is earning profits that are inconsistent with the story where profitis everywhere equal to productivity.

Incidentally, monopoly doesn't explain excess pay in Saez research.

I'm glad you made the point that economies of scale can lead to monopolies. This was my thinking as well, but the last time I made that point people didn't seem to agree.

ReplyDeleteAlso, I'd be careful with your definition of a bank. Borrowing short and lending long represents an activity that most corporations and investors do at least some of the time, and does not make you vulnerable to bank runs. The critical piece you need is actually the demand-deposit aspect, where depositors share the risk of the portfolio.

Couple more thoughts:

DeleteYour "critical mass" story doesn't fit with the bank run papers I'm familiar with. In them, if a single depositor withdraws early, all of them will, meaning that scale isn't likely to reduce risk of switching equilibria.

Perhaps a more fruitful area to look at is the role of information. Financial intermediaries serve as centralized information aggregators, and arguably this information coordination represents the main service that financial intermediaries sell. Since a large intermediary with tons of clients will have access to the private financial information about a much larger pool of firms and investors than a small intermediary, it stands to reason that there would be significant economies of scale.

Perhaps?

DeleteTypically the return to scale happens to the firm, here the return to scale happens to the product. This explains why a sector rather than a firm are benefiting.

The other features that are at work are ever increasing amount of the product relative to GDP. And price set as a percent of size.

Also, doesn't the FDIC take away the bank run explanation? In the US, the institutions that had bank runs were all non-bank financials.

Your "critical mass" story doesn't fit with the bank run papers I'm familiar with. In them, if a single depositor withdraws early, all of them will, meaning that scale isn't likely to reduce risk of switching equilibria.

DeleteThey leave the run un-modeled. It's just one of a multiplicity of Nash equilibria.

If you look at profits after tax, it's a lot closer to 50%. I took a hard look at this a year ago.

ReplyDeletehttp://www.angrybearblog.com/2012/01/where-has-all-money-gone-part-ii.html

What you say here is right on. But, if you take a 13 yr average of the finance sector profit share, a slope change in the mid-80's jumps out at you. I think what reason says above is correct about rent seeking.

The finance sector provides a vital function. It is there to facilitate and enable the wheels of industry to turn. But policy matters. What has happened in the age of deregulation and lax taxation is that the finance sector has come to dominate the economy. This is madness. And here is your Great Stagnation, folks.

Beyond the point of supplying necessary financing for businesses and mortgages, financial manoeuvrings - speculation in particular, and most especially so with sophisticated derivatives that nobody knows how to rationally evaluate - become rent seeking. This is a massive misallocation of resources, diverting capital from real investment into totally non-value-added financial tail chasing.

Estimates vary, since there is no good way to get a handle on it, but the highly leveraged derivatives market has a notional value somewhere between 10 and 25 times the aggregate value of global GDP.

http://seekingalpha.com/article/198197-why-derivatives-caused-financial-crisis

Paul Krugman calls the whole operation A Giant Scam.

http://krugman.blogs.nytimes.com/2011/11/23/a-gigantic-scam/

Here's Andrew Haldane, Executive Director, Financial Stability, Bank of England.

http://www.nakedcapitalism.com/2011/11/haldanemadouros-what-is-the-contribution-of-the-financial-sector.html

The net result is these rents retard real investment and hence GDP growth. Finance is cannibalizing capitalism. Deregulation has put this whole thing on steroids.

JzB

You can pretty easily eye-ball the slope change in the baseline scenario graph in the post.

DeleteJzB

Rather than focusing so much on the industry’s profits, should we be asking whether or not the GDP contribution number is understated? More specifically, doesn't the comparison of financial sector profits with the financial sector's contribution to GDP miss a lot of the value that the finance industry creates? This point was already made above, but there is a clear link between firms' access to finance and economic development. Without access to bank borrowing, a lot of firms might have much lower production, hiring, etc. than they do now, lowering overall GDP. And insurance allows firm managers to take "smart" risks with their business that they otherwise might not take.

ReplyDeleteI think there is a productive conversation to be had about whether or not financial firm profits are “too high” or whether the firms are more highly subsidized than they should be (my answer to both would be “probably”). But it seems to me that comparing their profits with their sector’s GDP contribution is unfair. A more fair comparison would be figuring out how much overall GDP would decline without the existence of the finance industry (which is, of course, impossible) and comparing that to current financial sector profits, or estimating how much reducing bank profits through reduced subsidies, law changes, etc. would affect their willingness/ability to lend (and its corresponding effect on GDP). There are a number of studies about how a credit crisis affects GDP as well.

Bill -

DeleteYou're asking the wrong question. Eliminating the finance sector would be like cutting off both your legs, and nobody is suggesting that. The point is to make it all work well together. Stringent regulation and high tax marginal rates, like we had pre-Reagan would be huge steps in the right direction.

But not a total solution, as Noah rightly points out.

Cheers!

JzB

"none of the above"

ReplyDeleteFinance and insurance companies book profits on an accounting basis, which may not reflect the bona-fide actuarial profit. In the 80s, much accounting was historical cost. Over time those have evolved to fair value, but its still not perfect. The problem with looking at profits is the bankruptcy option: when a bank goes under, it means that reserves for losses were insufficient, the economic losses are wiped out (but if we actually knew what they were to adjust the profits, we would get a clearer picture).

Now THAT is interesting.

DeleteI want a longer version of this with some good examples!!!

Couldn't it just be "greater financial intermediation"? That is, instead of borrowing from family, etc. to start a business or buy a house 100 years ago, people go to banks instead?

ReplyDeleteI sort of wonder if I'm invisible, or if I'm talking in Latin.

DeleteQui dixit quod?

DeleteNoah,

ReplyDeleteWould it be easy to pull together a stacked graph of profit share by industry over time? And that perhaps another one that graphed profit share over share of gdp over time? I'm curious how other industries look in these measures - GDP is weird in that it includes all of government, for example, which has profits set to zero by fiat. So, I'm wondering if every industry will "pull above its GDP weight" so to speak according to these measures. That said, I'm still betting Finance will come out close to on top.

I agree that it is dangerous to compare finance's share of total GDP with its share of business profits because GDP includes activities that do not count as "business". On the other hand, government suppliers, defense contractors and some hospitals caring for Medicare and Medicaid patients will count as "business" so some government spending is "business".

DeleteAll that said, it still seems excessive that finance is getting 30% of all business profits.

Asociologist, this sounds like a great research project! Have at it. :-)

DeleteNow here's the question: All else equal, are bigger banks less vulnerable to runs?

ReplyDeleteGary Gorton says yes,

"A comparison of the U.S. and Canadian banking experiences from the middle of the 19th century is a particularly instructive example of the importance of industrial organization in banking and its relation to central banking...

During the period 1870 to 1913, Canada had a branch banking system with about forty chartered banks, each extensively branched, while at the same time the United States had thousands of banks that could not branch across state lines. The U.S. experienced panics, while Canada did not. There were high failure rates in the U.S. and low failure rates in Canada. Thirteen Canadian banks failed from 1868 to 1889, while during the same period hundreds of bank failed in the U.S."

http://www.nber.org/papers/w9102.pdf (pages 4-5)

Incidentally, Canada had no deposit insurance at the time and no central bank. Thus, Diamond-Dybvig's policy recommendation for deposit insurance is not supported by the historical record--bank failures and runs were rare events in laissez-faire Free Banking systems (Canada, Scotland) that were not handicapped by misguided regulations (e.g. branching restrictions in the US).

That's interesting, thanks!

DeleteCanada, Scotland? - maybe it is just the dour outlook that comes from living at long latitudes (with long cold winters) that is the controlling factor here. Of course Iceland is another story - but the problems there weren't domestic.

DeleteRBS and HBOS were both based in Edinburgh...

DeleteIt is incorrect to say that Canada had no central bank. We had half a central bank. The Bank of Montreal (chartered 1817, still in business) was the bank to the Government of Canada since 1867 (and the old United Province of Canada since 1854). Since it had the government's deposits, it functioned as a defacto "lender of last resort", with the Department of Finance's blessing. The customary way to deal with a run was to arrange a firesale takeover with a stronger bank, through the Canadian Banker's Association. The Bank of Hamilton was taken over in 1922 by the Canadian Bank of Commerce through such an arrangement.

ReplyDeleteThis tactic was tried in 1985, in act all the Chartered Banks subscribed to an emergency capital injection into the two failing Alberta banks. It just wasn't enough, and they went under. Even then the Government stepped in an insured all deposits, not just those covered by CDIC. CDIC was never about prudential regulation, it was always about encouraging competition.

This is the reason that if you count bonuses as profits, 50% might be close.

ReplyDelete