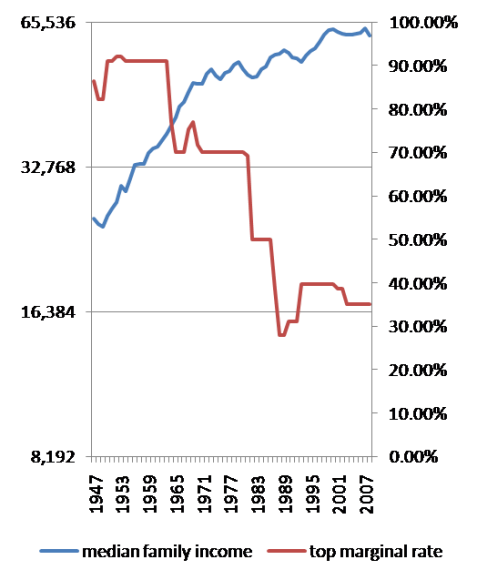

Read almost any conservative commentator on economic history, and you’ll find that the era of postwar prosperity — the gigantic rise in living standards after World War II — has been expunged from the record.Scott Sumner disagrees. He raised the point that in the 80s and 90s we performed better than our rich-world counterparts in Europe and Japan:You can see why: the facts are embarrassing....Basically, US postwar economic history falls into two parts: an era of high taxes on the rich and extensive regulation, during which living standards experienced extraordinary growth; and an era of low taxes on the rich and deregulation, during which living standards for most Americans rose fitfully at best.

This does not, to say the least, make the case for free-market orthodoxy. So a large part of the right has invented an alternative history in which the good years came after, not before, the Reagan revolution...

Now, here’s what I know I’m going to hear in comments: stagflation! Jimmy Carter! The 70s! You can sort of see the bad years of the late 70s in the figure; it’s that little downward wiggle in the middle.

[From 1980 through 2008,] four countries gained significantly on the US, two were roughly stable (Australia, Japan) and the rest regressed. The four that gained were Chile, Britain, Hong Kong and Singapore. Of course lots of poor countries gained on the US, but that’s to be expected. But I will show that the performance of every single country on the list is consistent with my view that the neoliberal reforms after 1980 helped growth, and inconsistent with Krugman’s view that they did not. Krugman makes the basic mistake of just looking at time series evidence, and only two data points: US growth before and after 1980. Growth has been slower, but that’s true almost everywhere. What is important is that the neoliberal reforms in America have helped arrest our relative decline. The few countries that continued to gain on us were either more aggressive reformers (Chile and Britain), or were developing countries that adopted the world’s most capitalist model.Krugman issues a rebuttal:

[Sumner's article] it’s not a response to my original point. That was about the claim, quite common on the right, that the US economy was stagnant until Reagan did away with those nasty New Deal policies — a claim that is simply, flatly, false. The era of strong unions, high minimum wages, high top marginal tax rates, etc. was also a period of rapid growth and rising living standards. That doesn’t prove causation; it does disprove the widespread dogma that these things are always economically devastating. And it’s telling that so many on the right have airbrushed the whole postwar generation out of history.The problem here is that we only have one instance of history to look at. We don't know for sure what would have happened if Reagan hadn't cut taxes and deregulated large sectors of the economy. In economics parlance, we have no "counterfactual". Our "theories" are only educated guesses, and it will stay that way until we figure out some way to do macroeconomic experiments (that is a story for another blog post).

In this particular case, it seems to me that Krugman and Sumner are both basically right, and thus are talking past each other. How can they both be right?

Well, Krugman is absolutely right that history shows that high taxes on the rich do not necessarily cripple an economy. I say "necessarily," because it may be that something changed in the 70s or 80s that made high tax rates much more harmful (that "something" being globalization); hence, high tax rates might not have hurt us much in the 50s, but might have hurt us more had we kept them in the 90s. But conservatives typically make the argument that high tax rates on the rich hurt the economy because discourage people from working, and discourage them from trying to become rich. History clearly shows that that idea is wrong.

And Krugman is also right to deride the GOP's fiction that Reagan saved us from economic doom. He very well may have, but we just don't know if he did or not.

But Sumner is right that the U.S.'s performance post-1980 is not nearly as bad as Krugman makes it out to be. Our GDP growth did indeed exceed that of most rich countries over most of that time period, and our productivity per hour consistently beat those other countries even though we work as much or more hours than anyone on the planet. That is an indication that our performance from 1980-2000 was, in fact, pretty good.

What I personally suspect is that in the postwar years, the U.S. was still in a phase of "Solow catch-up," where we were investing heavily to equip our companies with the slew of new technologies invented before and during WW2 (Japan and Europe were growing faster than us because they had more of this catch-up to do, partly because of WW2 itself). In the 70s, we hit the limits of catch-up growth (as did Japan and Europe); after that, we could only grow by inventing new stuff. When this happened, institutions that we had in place to encourage high saving and rapid investment - which possibly included strong labor unions and a bunch of industrial regulations - became more of a burden and less of an advantage than during the high-investment "catch-up" phase. Those countries that kept their industrial-policy institutions in place (Japan and Europe) lost some ground to those countries that partially scrapped those institutions (the U.S.). So the Reagan/Clinton policies were right for their era, but wouldn't have been good in the postwar era.

But again, that's just my guess.

But both Krugman and Sumner leave out a huge fact: the enormous debt that all rich countries have racked up since the growth slowdown of the 70s. A large part of that debt, in the U.S., is due to tax cuts unsupported by spending cuts; a policy started by Reagan and enthusiastically continued by Bush I and Bush II, and only temporarily reversed by Clinton. Few economists would argue that the rain-or-shine deficit spending embraced by our Republican party since 1980 has been good for our economy. It is the GOP's addiction to deficits, not any issues of tax rates or regulation, that will be the biggest drag on our economy in the decades to come.

Update: Sumner agrees that he didn't address Krugman's central point. He then proceeds to make a number of good points, some of which I shall now quote:

Obviously not every neoliberal reform was a success. Banking deregulation went poorly, and electricity deregulation in California went poorly. But even in the Nordic countries it seems the neoliberal reforms are accepted as being necessary...The European countries have also continually slashed their corporate tax rates, to levels far below the US. How does Krugman feel about that? Some have no capital gains taxes, or inheritance taxes...Sumner's story about policy, technology, and growth basically agrees with mine...but that's not why his points were good. His points are good because he points out that the tax and regulatory regimes that are harmless in one era may not be harmless in another era.

My point is that it isn’t obvious that a liberal like Krugman would oppose the general thrust of the neoliberal revolution. I doubt he wants to go back to an era where many western governments owned big manufacturing firms like steel and autos, set airfares, and had 90% tax rates. On the other hand his posts on the topic often suggest that the 1945-80 period was a sort of Golden Age, and we’d be better off trying to recapture that era...

In my last post I argued that the growth of the 1950s and 60s resulted from a technological revolution that began in the 19th century and hit a wall around 1973. At that point growth slowed almost everywhere in the late 1970s and 1980s, even before neoliberal reforms were put into effect. Indeed that’s partly why they were put into effect. And the evidence shows that the faster reforming countries did better than the slower reforming countries...

The Soviet regime produced very rapid growth in living standards between 1945-73. I claim that that record of success doesn’t disprove the assertion that by the 1980s that same system was “economically devastating.” The US system during that period was far better than the Soviet model, but also had features that undermined performance in the long run.

Which does not invalidate Krugman's point, which is that conservatives are wrong to believe that taxes and regulation are always bad for the economy. These guys are both making good points, and they think they're arguing with each other...

Update 2: Tom Bozzo and Mark Thoma agree that counterfactuals are important in evaluating history...

I completely agree!

ReplyDelete