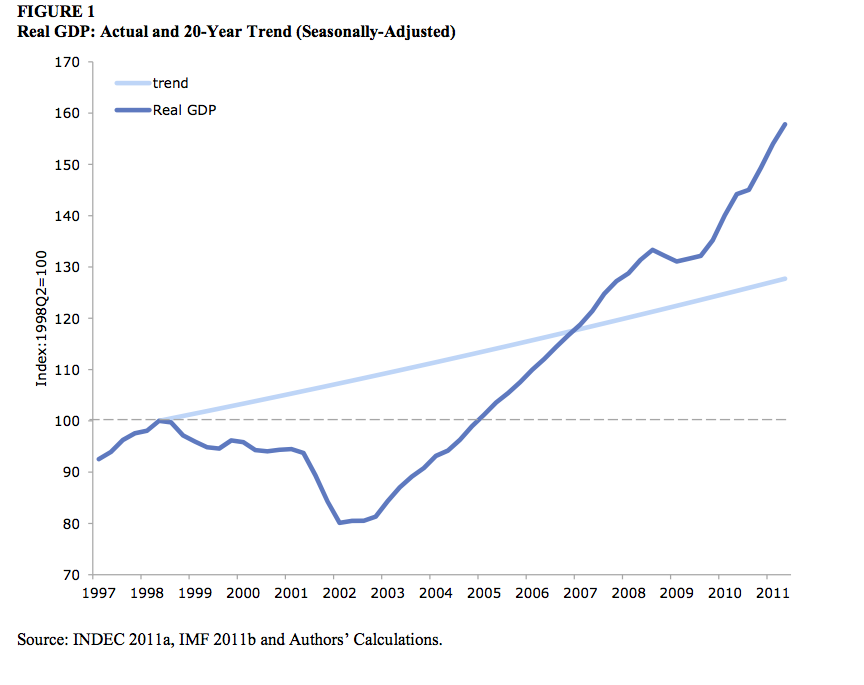

There are two reasons to think about what happens in the eventuality of a Japanese sovereign default. The first is that Japan's debt might be big enough, and its bond market reluctant enough, that it is forced to either default, hyperinflate, or go into severe austerity mode. In that situation, a default might be the best option. After all, after Argentina defaulted on its debt in 2001, its economy suffered for three years but then did quite well, substantially outperforming its pre-default trend:

That looks like a decently good macroeconomic scenario. And far from being an exception, this story is the norm:

So the precedent for a default is not apocalyptic. Whether this is better than hyperinflation I will leave unanswered, but it seems likely to be better than a long grinding period of austerity-induced stagnation. Also, note that austerity would redistribute wealth from Japan's young to Japan's already-comfortable older generations; a default, in contrast, represents a big transfer of wealth from the pampered old to the struggling young.

The second reason to contemplate a default is microeconomic. Observers of Japan's economy are nearly unanimous on the need for "structural reform". But Shinzo Abe's offerings on that front were extremely anemic. And given the huge edifice of special interests in Japan, and the weak political system there, we can probably expect little progress on that front.

Structural reform is needed because Japanese productivity is stagnant. Here's a graph, from Takeo Hoshi's much-cited paper:

Hoshi attributes the stagnant TFP to "zombie" companies - companies that continue to live only through repeated infusions of below-market-rate loans. These zombies, he claims, crowd healthy, productivity-growing firms out of the market. His research with Ricardo Caballero and Anil Kashyap supports this story.

My own suspicion is that low TFP growth is also partly due to poor corporate governance in Japan. Here is a blog post I wrote about that.

A third, and related reason for low productivity growth may be the high prevalence of family businesses in Japan. There is evidence that family businesses experience slower productivity growth than non-family businesses. In this way, Japan may be similar to Portugal; I encourage everyone to read this Matt O'Brien post on family businesses and stagnation in that country.

For structural reform, Japan would need a huge blast of "creative destruction". Zombies and family businesses would need to die en masse, and healthy, independently run companies would need to emerge. The U.S. got that kind of blast in the 1980s, but Japan is unlikely to slash regulation, open up trade, and let the corporate raiders into the henhouse. The equilibrium of entrenched political interests is too strong.

Only a big external shock is likely to be able to cause the kind of destruction needed to clear away Japan's economic ancien regime. A default would do the trick. Banks would go bamkrupt and be nationalized, and they would be forced to cut off zombies, which would then die en masse. If Japan's history is any guide, a huge burst of entrepreneurship would probably follow this die-off; witness the emergence of Sony and Honda after the shock of WW2.

So there might be some very good reasons for Japan to choose a sovereign default. But of course there would also be large costs. What would those costs be? I see three big ones: Human cost, inequality, and political risk.

The human cost could be a jump in the already sky-high suicide rate. A large number of Japanese suicides are men who lose their jobs. The close family structure of companies means that these men essentially lose access to their entire social support network. Combine this with a culture that is not very forgiving of failure, and you begin to see why a spike in unemployment might cause a large number of self-inflicted deaths.

Then again, this cost is not certain. A recovery of dynamism in Japan's economy might ultimately save more lives than it took. And human psychology is a fickle thing; it might be that in the wake of a default, unemployment might be seen as a natural disaster rather than an individual failure, and the suicide rate might even fall.

A more definite cost would be a rise in inequality. Once famed for being a middle-class society, Japan has experienced a rise in inequality over the past two decades; it is now less equal than Europe, though still more equal than the U.S. A default might change that. Family businesses might hold back productivity, but they also anchor the Japanese middle class; if large numbers of them went under, that middle class would be set adrift.

Finally, the biggest cost of a Japanese default would be political risk. As can be seen from Argentina's example, defaults are often followed by steep drops in GDP (and rises in unemployment) that last for two or three years. That might be bad enough to destabilize Japan's already weak political institutions, and prompt the fall of the post-WW2 regime. That in turn would likely involve violence, social disruption, and increased social repression. If the winners of the coup were the "authoritarian nationalists" - basically, Shinzo Abe and his crowd - then things might not be so bad, since those guys are generally responsible and committed to a strong, stable nation.

But if the victors were the "fanatic nationalists" - think of Toru Hashimoto and the guys in black vans - then Japan would be in for a very bad time indeed, and would quite probably revert to an unstable, violent, socially divided, repressive middle-income country like Thailand. That would be the worst possible outcome of a default.

So basically, a default would constitute a roll of the dice - a dramatic gamble that a collapse in the old order would be followed by a repeat of the kind of explosion of positive dynamism seen in the post-WW2 economic miracle or the Meiji Restoration. If the gamble failed, however, the consequence could be the end of the beautiful, peaceful, relatively free Japan that many of us have come to know and love.

Some Investor Guy wrote a series in Calculated Risk's blog about how bad can things get in the worst case scenario when Japan and many other countries default. You might take a gander at them.

ReplyDeleteSounds really interesting. Got a link?

DeleteHere is the link to part 5 something.

Deletehttp://www.calculatedriskblog.com/2010/08/sovereign-debt-part-5d-european-banks.html

I think you can navigate from there.

Best

Thanks!!

DeleteRegarding family businesses in Japan, while there are many genuine family businesses, lots of families in Japan incorporate just as a means of avoiding death duties. As such a huge number of "companies" included in the statistics can't be regarded as real companies at all, and so can't be seen to crowd out or hold down productivity.

ReplyDeleteAlso the beneficial tax system for small companies means that it makes sense for small companies to make a small "loss" every year, but this is just an accounting trick and doesn't mean that all small companies are actually unprofitable.

I think that excluding all companies under say five or ten employees would give a more accurate picture of the economy in Japan if you want to find "zombie" companies being kept alive by cheap loans.

Good point.

DeleteOn the flip side, many real businesses are kept "in the family" in a strange way: 98% of adoptions in Japan are of adult males aged 25-30, primarily as a way to have the "family business" run by someone who is good at running businesses.

Deletehttp://www.freakonomics.com/2011/08/09/the-church-of-scionology-why-adult-adoption-is-key-to-the-success-of-japanese-family-firms/

This is an old trick; Augustus Ceasar is perhaps the best-known example.

DeleteStill didn't get a response concerning hyperinflation from your last post:

ReplyDeletehttp://noahpinionblog.blogspot.com/2013/06/the-zero-upper-bound.html?showComment=1370904673145#c7502996210203413678

Tell me, how is it that putting more government base money into a deflationary economy (or depressed with an output gap for the US/Spain/UK etc.) would lead to hyperinflation? You just simply assume this to be so, without providing an explanation. Are you reading a little too much zerohedge? ;)

I'm seconding this. It sounds like Noah has a bad case of 'yelling 'Fire!' during Noah's Flood'.

DeleteIt sounds like Noah has a bad case of 'yelling 'Fire!' during Noah's Flood'.

DeleteIt's my flood, I'll call it whatever I darn well please!

What about the stigma of default? It's hard to believe that anyone would be willing to take that fall, on their watch.

ReplyDeleteI was surprised that Abe only went with a 2% inflation target, instead of something more like 4%. It seemed a little timid at the time, and still does.

But, I don't think they can even hit 2% with current policy. Why not monetize the debt *until* you hit 4%? Lot's of people are writing about helicopter money lately.

Of course, they'll still need structural reform and probably more transfers, there will be winners and losers.

They have a HUGE demographic headwind that will be with them a long time. Something needs to offset that or they will continue to implode.

Yep, that's what Kuroda needs to try next if the current thing doesn't raise inflation.

DeleteIf they could get some strong economic growth and structural reform, then they might increase the incentives for greater robotics inventions in order to offset the declining size of the work-force (I assume that a less economically stable Japan is probably going to be even less favorable towards immigration).

Delete1) If I think default is seriously contemplated as a policy of government, why don't I just bury commodities in the back yard?

ReplyDeleteThat will gin up the old money multiplier, right?

No interest payments, but my principal isn't confiscated by the sh*t-heel State for the purposes of political bribery (beyond the current extent)

(Why do you think ZIRP here is really ZIRP+1? The commodities savings option keeps Zimbabwe Ben above absolute 0%).

2) And confiscation through default will do wonders for long-term work incentives, business investment, and public confidence going forward, right?

I mean, government driven uncertainty ("unprecedented monetary/fiscal policies") has worked wonders here and in Japan, right?

In Japan, twenty-years of Keynesian stimulus (calculated default on the installment plan) has accomplished what exactly?

Arriving exactly at the point all the skeptics anticipated all along ("Gee, how bad could default really be..." and "How could *anybody* be expected to service a 230% GDP to Debt ratio" and "It is those damn creditors' fault for trusting us with their money")

3) The equivalent for the emerging markets on your chart is capital flight - the people/creditors in those nations have learned (through repeated bitter experience) not to trust their "governments" (alternating mafias is more accurate).

See Argentina for a *long term* example of a nation very richly endowed with natural resources but cursed across *generations* by "clever" politicians and, one imagines, their familiars...establishment economists and journalists preaching default, "just one last time".

How have non-defaulters done over the last 100 years, relative to defaulters - whose word is sh*t?

(Btw, why trust someone to tell you accurate GDP figures when you can't trust them to return your principal?)

4) Also, how does a politically calculated default gibe with the Fifth Amendment's Takings Clause (sure we are talking about Japan...right...).

Calculated default - just another great idea brought to us by political class PRISM-guards.

Forgot to mention: awesome twittering today v cullen!!!!

ReplyDeleteThanks! Did you think I was on to something?

DeleteAbsolutely! – btw, I was on the edge of my seat refreshing Twitter like a mad man!

DeleteHe does claim, often and everywhere, “a superior understanding of the macro economy” (from his website). His marketing literature from his website surely promotes that idea, and is a major selling point, if not “the’ selling point: “We use a complex institutional understanding of the monetary system to provide superior market insights, research and investment ideas.” One of his papers accessible to subscribers (yes, I paid the $500 for a subscription. I subscribe to a lot of others too) is titled “How to benefit from Orcam Research”, and the general gist is by “a better understanding of the macro world”.

So, when he makes a claim like: “it’s rather disingenuous to claim that economists generally understand endogenous money. They don’t”, which he makes a lot in various forms, am I supposed to think that most economists are a bunch of idiots – because that’s the flip side? I’m cynical, but I’m not ready to go that far.

On the other hand (hah!), there is some confusion *out there* on specifics – which gives people like Cullen an opening:

http://www.creditwritedowns.com/2012/04/progress-on-the-monetary-policy-and-banking-debate.html

So, why don’t you clear this up for us once and for all?

I still think that the alternative (the BoJ writing off all/part of their bond holdings) is the more logical outcome.

ReplyDeleteAlthough perhaps a shock for financial markets, it would not be the much needed shock therapy for the real economy...

Easier to default when you owe money to other people (Argentina), less so when debt is domestic (Japan).

ReplyDeleteWe know the route the Japanese want, BoJ's QQE is really a commitment to default by keeping bond yields low and targeting higher inflation (sold under the politically more digestible 'financial repression' moniker).

Of course they still might be choked by the deflationary demographics before they have reached a point where the debt burden starts to look even vaguely reasonable.

Abe's third arrow is a big ask in this respect. Not only does this hinge on structural reforms that would seem to go against the grain of Japanese culture and the entrenched interests of the incumbent post-war/retired generation, but the required increase in productivity growth needs to pass the demographic hurdle too that is dragging on GDP growth.

Abe is popular but its rare for politicians to stay the course and I'm doubtful he is as committed to the third arrow as his entourage suggest he is.

Exactly so. Default is a transfer of wealth. Transferring wealth to domestic interests from foreign interests is much easier politically and socially (within one's own borders) than transferring wealth from one domestic interest to another. Since Japan's sovereign debt is a large multiple of GDP, any default worth doing would transfer a large amount of wealth between domestic interests.

DeleteJapan's quadrillion yen of JGB "savings" is simply taxes they've been skipping out on since 1990 or whenever.

DeleteIt's not wealth!

It's a claim on wealth though, and I find it bizarre that the System expects Japan's future, smaller taxpaying base to pay the bill on their parents' colossal bad debt bubble hangover.

The soft default of adding another digit to domestic prices (and wages!) is the only way to go; all rests on Kuroda having his way.

Default?

ReplyDeleteHow about monetizing instead?

BoJ buys back all the remaining outstanding public debt.

The Treasury then stops going to the private markets to ask for financing. The BoJ will provide its financing from then on.

If this can cause some inflation, great. That's what Japan needs right now.

I think they should try this. It might work!

DeleteBut if this makes everyone expect that the monetization of debt will be a permanent policy, hyperinflation, not normal inflation, will be the result. Now, hyperinflation is similar in most ways to a sovereign default, so much of what I said applies equally to that scenario too.

I think you should set forth your definition of hyperinflation before using it so much.

DeleteCertainly you can agree that although there is a consensus around such cases as Zimbabwe as "hyperinflation", at the same time, there is no consensus regarding the close cases.

I am really surprised given your normal reasoned tone that you keep using (the somewhat inflammatory) "hyperinflation" when I'm not sure you've excluded the possibility that sustained 8% annual inflation would massively change the situation in Japan.

(of course, that's why I'm interested in your definition, because if you think 8% annual is hyperinflation, there's the reason!). But surely, even though we "know it when we see it," there can be no "right" answer in the close cases of whether what is being experienced is "hyperinflation."

Noah, you may want to link to this IMF paper regarding long-run costs of default: http://www.imf.org/external/pubs/ft/wp/2008/wp08238.pdf

ReplyDeleteIt's from Eduardo Borensztein and Ugo Panizza and finds that the economic costs of default are deep, but very acute, and not at all prevalent in the medium and long runs.

But I am worried about your thesis because it is strategic. Default and inflation *as a last resort* are okay because the markets don't think the government is trying to cut and run. In one of my very few hawkish pieces, I criticized RR for supporting 4% inflation as not a means to an end, but end in and of itself (http://ashokarao.com/2013/05/24/am-i-more-hawkish-than-ken-rogoff/):

"However, that’s only the tip of this dangerous iceberg. Inflation for the sake of inflation is a partial default on our obligations (aside from social security and TIPS, of course). I think debt forgiveness is a remarkably important component of the new international finance system. But it is a signal of fiscal irresponsibility and recklessness, neither of which afflict America today.

Our debt-to-GDP ratio is historically high, but nothing unsurmountable, especially at the low cost of capital today. The next decade is relatively stable as far as deficits are concerned, and there’s no reason to believe we won’t implement the necessary adjustments come what may after 2023. For this reason, inflation as a cop out of our obligations will send the wrong message:

---The Federal Reserve will loose credibility – that is, investors will forever think that we will inflate our way out of even tolerable debt burdens."

Japan's debt is clearly not as stable as America's. However, markets are lending for cheap, and I worry about the political signal such sends, as all big defaults we know happen out of sheer impossibility otherwise.

And it does turn out that there's more to my fear than hot air (from the IMF paper):

"A different possibility is that policymakers postpone default to ensure that there is broad market consensus that the decision is unavoidable and not strategic. This would be in line with the model in Grossman and Van Huyck (1988) whereby “strategic” defaults are very costly in terms of reputation—and that is why they are never observed in practice—while “unavoidable” defaults carry limited reputation loss in the markets. Hence, choosing the lesser of the two evils, policymakers would postpone the inevitable default decision in order to avoid a higher reputational cost, even at a higher economic cost during the delay."

Why "hyperinflation", Noah? Why not just enough inflation to bring the debt down to whatever is regarded as sustainable?

ReplyDeleteAlso, if Japan needs strategic restructuring, and needs to kill zombie firms, why doesn't the government just invest directly in the new industries and hire the workers it needs from the dying zombie firms, with benefits and dignity intact? It can create an innovation and development nursery, and as viable new companies are created they can be spun off into the private sector. Why go the route of chaotic creative destruction + suicide?

Why "hyperinflation", Noah? Why not just enough inflation to bring the debt down to whatever is regarded as sustainable?

DeleteWell, the hope is that that is possible. That would be the "first best" solution, as they say in economics...

Also, if Japan needs strategic restructuring, and needs to kill zombie firms, why doesn't the government just invest directly in the new industries and hire the workers it needs from the dying zombie firms, with benefits and dignity intact?

Because the government is captured by the incumbent interests.

Because the government is captured by the incumbent interests.

DeleteWell, OK. But then I would suppose the incumbent interests are also opposed to default as well, since over 90% of the Japanese debt (no?) is owned by the Japanese people.

Wasn't Japan's earlier period of dynamic growth driven by big state investments and subsidies? Why not do it again?

Well, OK. But then I would suppose the incumbent interests are also opposed to default as well, since over 90% of the Japanese debt (no?) is owned by the Japanese people.

DeleteYes. But default happens quickly and is irreversible.

Wasn't Japan's earlier period of dynamic growth driven by big state investments and subsidies? Why not do it again?

Again, because of incumbents. Incumbents make sure that subsidies go to established players instead of new, growing enterprises.

But there have always been incumbents. Your position seems too defeatist to me. A Buchanan-like that the government can't organize anything important because government is just GE and Pepsi by another name. This is ahistorical.

DeleteBut there have always been incumbents. Your position seems too defeatist to me. A Buchanan-like that the government can't organize anything important because government is just GE and Pepsi by another name. This is ahistorical.

DeleteBut is this never the case, or only sometimes the case and sometimes not?

I think the same could be said for the USA. Reading this article, I believe default is the best option also for the USA, considering their huge debt and low growth, created printing money. So, why defautl is the best option for Japan and not also for the USA? Meh.

ReplyDeleteShould NYC subway default on its promise to accept tickets it issued? Is this "the best option"? Should the Post Office default on the promise to accept the stamps it printed in payment for postage? Noah doesn't know what he is talking about here. Japan doesn't have and will never have any problem in meeting its obligations, it ONLY promises to exchange yen for yen (in form of bonds and cash) and accept them in payment of taxes. It can always control the exchange rate between its IOUs. It chooses to let the market play with the long interest rates, but it is a CHOICE, it could set them like it sets the short rate, even to zero. It has its own currency, is not on a peg like Argentina or not using a foreign currency like Greece which would put it in a position of potentially being unable to meet its obligations.

DeleteI don't think that default is the best option, indeed. Simply, I was ironically wondering why it should be good for Japan and not also for the USA, since also the USA have a huge debt, a weak growth, and print money like there's no tomorrow.

DeleteLOL, you got me! :). Let everybody default, should be fun! Gotta love economics.

DeleteNoah,

ReplyDeleteIf a celebrity gives out autographs that are a promise to accept them back and exchange them for other, identical autographs, can this celebrity ever be forced to default on this promise? It is nonsensical. And this is what a sovereign debt is. Japan only promises to exchange their IOUs to other identical IOUs and accept them in payment of taxes. They control the exchange rate (interest rate) - it is clear for short maturities but at long maturities it works the same. The US showed this during WW2: they set the rate on 10yr note to 1 and 3/4% and that was that. They could set it to zero or not sell bonds at all. You post is like wondering if the banker in the Monopoly game should default on his promise to accept the money it issued to players in payment of fines. It makes zero sense, it would destroy the game. Hyperinflation doesn't help the central banker at all - his promises are nominal, not real, he still exchanges a dollar for another dollar and accepts them in payments of fines.

You cannot compare Japan to Argentina. Argentina promised its currency to be 1-1 to dollar, on this promise they defaulted but no need to default on the promise to exchange a peso to another peso (in the form of a bond or cash, no matter).

You get pleas from people to learn basics of the monetary systems from MMT-ers. This is not to please some internet cranks, but to stop you from writing inanities.

Just the other day I was thinking that even though Noah is a smart guy and entertaining blogger, sometimes it seems like he knows fuck all about macroeconomics beyond DSGEs. And then he writes this ridiculous post and basically proves me right.

ReplyDeleteThis is true of most mainstream economists. They can talk about general equilibrium in 11 dimensions but cannot figure out if transfers of money to the private sector are more expansionary than asset swaps and compare finances of money printing entities to those of households. Lots of talk about seventh-order effects and no clue on the first order effects, no clue how money works, how balance sheets work, how credit works, how spending impacts jobs, how spending is financed, what form of financing is sustainable etc. etc.

DeleteActually Noah has never pushed DSGEs. I really do not understand what the f*k YOU guys are railing about. He is not putting forward a policy prescription here. Just a very interesting scenario. If you want pure policy oriented stuff why don't you read the garbage put out by most street macroeconomists, who write according to the mission of their firms.

DeleteIf you are looking for just dry research go to the CBO's publications!

Som Dasgupta,

Deletehe is putting forward a scenario that makes no sense whatsoever for a sovereign currency issuer, that is the point.

And in general when an economist puts out a 'just thinking, here............' scenario, it's not 'just thinking', it's pushing a line. Especially since the scenario of Japan defaulting is not a likely thing.

DeleteHey Noah

ReplyDeleteNot having gone through all of your arguments (will do so after 4:00 pm), what do you think are the chances of Shinzo Abe abolishing the corporate depreciation allowance (at least reducing it greatly). This is precisely what makes the corporates cash rich to the point of total zombieness?

You cannot expect someone to understand something when they are paid not to understand it.

ReplyDeleteAcademic Macro has no idea how the monetary system actually works but has built up this industry of text book, government regulators, and punditry which, through it ignorance, causes huge suffering. What are they going to do, say "oops we have no idea because we do not understand double entry book keeping?"

You should know that INDEC's GDP measure (as well as its inflation and poverty statistics) has been manipulated. Argentina's actually grew much less than reported from 2007 onwards. Anyway, it still would be higher than that trend in the chart.

ReplyDeleteGreetings from Argentina

Natalio Ruiz (economist-blogger)

Why would Japan ever default? They have their own sovereign currency. (Argentina's currency was pegged, hence not sovereign.) There is no need to. Their exchange rate will handle any investor concerns. Quite simple stuff, really, using MMT.

ReplyDeleteGood post - especially appreciated the last paragraph laying out the swings on either end. I feel like economists in general should do more of this after laying out their arguments as "lay" people like me can have a set of consequences in either direction to parse through. Helps with making an "informed" choice when it comes to major policy decisions and where economics weighs in on them.

ReplyDeleteI remember this happening in smaller form back when the economy imploded in 2008 and 2009, but it seemed to generally be about economic bases, etc. etc. and not "your society might look like THIS or THIS depending on which direction you choose and how those choices work out or don't."

Keep it up - it's good for the overall discourse and makes for interesting reading.

Interesting post; however, as other posters have noted, I don't see any reason why Japan would have to default on its loans.

ReplyDeleteNot have to...choose to!

DeleteNS,

DeleteI think you are missing the black heart of the MMT crowd's argument - "Why do anything as inflammatory as explicit repudiation of national debts, when you can accomplish the same result through the surreptitious dilution of the entire savings base - by 100% central bank financing of any desired level of fiscal expenditure."

The MMT'ers are basically saying that you can simply (and consequence-lessly) print money for everything - pay off the interest, the debt, any desired level of spending, etc.

Your citizens/creditors are your b*tches, because they are required to hold your currency - which you can dilute at will through Central Bank operations.

And, true enough, in a hothouse, tautological sense.

Anybody required to hold your currency can be herded into the ZIRP cattle cars. There is a reason why it is called financial repression.

But it is that *required* part that the MMT'ers screw up on.

They assume it away as part of their models.

They willfully ignore the real world consequences of expropriation through dilution - pissed off savers learn their lesson and respond in ways that are very counter-productive to the real economy (using commodities as a store of value instead of a debauched currency - see 2008, halting trade in the wake of great uncertainty as to the true, stable value of the received currency, etc.)

It isn't difficult to not "get" the MMT argument because,

1) In the real world, normal people understand the consequences immediately and

2) MMT'ers don't really want to be up front about what is really going on - the systematic confiscation of private savings through government led dilution and debauchment. So they talk in convoluted phrases that amounts to "Trust us - it has to work".

And it will - right up until the moment when there is an alternate currency revolution or real trade collapses due to store of value uncertainty.

Next up, Keynesian stimulus through pyramid building upon pain of death...

Anonymous,

DeleteNo MMTer proscrbes inflation, they think such prescriptions (eg. by Krugman) are nonsensical. Deficits are there to ensure that aggregate demand = full employment demand. Good stewardship requires avoiding inflation. The state doesn't gain anything by diluting its currency. Before Japan has hyperinflation the interest payments on its debt, combined with other government spending will be enough to ensure full employment at which point you stop increasing the debt.

Noah,

Japan *choosing* to default is like America choosing to nuke its major cities, it is simply idiotic to ponder this question pretending to be doing economics, this falls under politics/psychiatry.

"No MMTer proscrbes inflation"

DeleteHow are the perpetual government deficits financed other than by Central Bank operations (essentially, money printing)?

MMT's are quite fond of saying that creditors to the sovereign are unnecessary - 100% of deficits can be funded by the Central Bank - which can only do so through money printing - which can only dilute the value of the current currency-savings base, as the real world asset base it is supposed to represent is unaltered by all the monetary jiggery-pokery.

The MMT's unspoken response - yeah, well, what's anybody going to do about it?! We control the currency, the tax laws, and the "legally required" means of exchange - therefore, our citizens are our b*tch and our savers are our saps.

It is a perfectly authoritarian world view (actually, totalitarian, given the thoroughgoing nature of the economy) - it ignores any understanding of property rights (savings are confiscated through dilution, with nary a vote nor a Constitutional Amendment).

All in pursuit of "Optimal Aggregate Demand/Full Employment" - whose levels, if bothered to be described at all, are measured relative to the standards of the bubble-besotted past, rooted in *that era's* grotesque ZIRP-driven, capital misallocation.

God knows we built 2 million unnecessary McMansions from 2003 to 2006 on the back of ZIRP-derived monthly mortgage payments but it got us that much closer to Optimal Aggregate Demand!

For a while.

Until it didn't.

So what is needed now?

More cowbell.

The argument is that all this government spending (purchased at the price of vastly diluted private savings - the Nigerian MMT's "ALL YOUR SAVINGS IS OURS" approach) will result in re-ignited private sector activity and therefore tax revenue, outrunning the consequences of the ZIRP.

Japan hasn't reignited in the last 20 years of ZIRP.

That is a lot of cowbell.

Another thought - it seems to me that MMT'ers aren't actually saying inflation won't happen, what they are really saying is that it won't matter to the *government* (which can always set its own borrowing rate to zero through Central Bank lending).

DeleteTherefore no interest rate spikes (to *government*) and therefore no 250% Debt-to-GDP interest rate death spirals.

But government controlled Central Bank operations won't ride to the rescue for *consumer inflation* - there is still 2 trillion plus (200% increase) in very new high-powered money sloshing around in the financial system out there - the real asset base it is supposed to represent has perhaps grown 10% in that time.

In other words, the Fed can immunize the Administration from the interest-rate consequences of its actions, but it can't negate the consequences of a vastly altered nominal money/real asset ratio - 3 times the money chasing 1.1 times the goods.

At *best*, asset inflation will occur instead of goods inflation - so the asset inflation can be labeled a "recovery" and not inflation at all (unless you want to buy a house, or you had a previous, now diluted, claim on said assets).

Anonymous,

Delete"How are the perpetual government deficits financed other than by Central Bank operations (essentially, money printing)?"

They are ALWAYS financed by printing *something* or creating something out of thin air. All money is debt. If the government runs a deficits we always have obtained some asset, some form of "money". Treasuries are also money, they are liquid and are exchangeable to other government IOUs (like dollars). There is no difference in financing the deficit by printing dollar bills or by printing Treasuries.

You rant about how all this "money printing" causes inflation. Question for you: what is the correlation between deficits (which create money or money like assets) and inflation? Check it out, it is NEGATIVE 20%. Figure out why. The government has been "printing money" for the last 200 years, every year and dumped it into the economy yet no hyperinflation. Why? Because our economy is eg. 6x larger than in the 1950, no wonder it craves 6x the amount of dollars we had in the 1950s, so the additional dollars had to be printed and spent into the economy and not taxed back (deficit). That is why we have 6x as much stuff as in the 1950s, because we can afford 6x as much stuff and the economy responds with supply. Of course you can overdo it, but we didn't.

"God knows we built 2 million unnecessary McMansions from 2003 to 2006 on the back of ZIRP-derived monthly mortgage payments but it got us that much closer to Optimal Aggregate Demand!"

They were funded with PRIVATE debt, not public debt, that is actually the problem. 2 million mansions cannot be unnecessary, there is a ton of crap housing people would swap into mansions if they could but they cannot afford it. We didn't run out of raw materials or eagerness to live better, we ran out of money. So there was not enough money in 2008 to continue living in better houses. Because financing with private debt is unstable. If we had stable financing we could all live in those mansions that are now left to rot, which is stupid. If we can build them we should live in them.

"Anybody required to hold your currency can be herded into the ZIRP cattle cars. There is a reason why it is called financial repression."

You are not required to hold currency, you can send it to me if you hate currency so much. Do you realize that paying the interest rate is a CHOICE of the government? Nobody owes you interest just for owning dollars. You sound like it is your God given right to be sent checks by the government for nothing.

OTOH I don't think ZIRP can help at all these days, this is the belief of Krugman et al which I think is stupid: they forget that ZIRP invites people to borrow more and become more leveraged, the opposite of what I think we should encourage.

Read Bill Mitchell on MMT and inflation because you are very confused in what you think MMT says.

Anonymous,

DeleteTo continue:

" there is still 2 trillion plus (200% increase) in very new high-powered money sloshing around in the financial system out there"

MMT does not prescribe QE, printing the "high powered money" because it is not high powered at all. QE doesn't cause inflation, it doesn't cause anything other than lowering rates and forcing money managers into riskier assets and creating bubbles in stocks and commodities despite a weak economy. Monetary base doesn't cause inflation, there is no money multiplier. You sound like an Austrian, so read this: an Austrian scholar saying that the money multiplier never existed, he is right: http://libertarianpapers.org/articles/2010/lp-2-43.pdf

Both in Japan and in Sweden printing a ton of "high powered money" via QE (which is an asset swap and does nothing) coincided with... decreasing inflation.

There is no "3 times the money chasing 1.1 times the goods" because the monetary base does not translate at all into deposits. The private sector lost trillions in assets in the real estate collapse. Deficits give it trillions to replace those, therefore deficits act expansionary and can be inflationary if not decreased at full employment. But QE and having "(200% increase) in very new high-powered money sloshing around in the financial system" is simply buying 2T bonds with 2T in dollars, changing how banks and we store assets, it has very little effect. It is like someone switched your savings account into a checking account. Do you have more money? Are you running to spend it like crazy? You are saving more if anything because you just lost interest income.

Again, you keep talking as if MMT pushed policies that create inflation. It does not push some policies you bemoan and these policies are not even inflationary (QE), you need to learn more how the monetary system works. Start with the Austrian article above and this:

http://pragcap.com/understanding-modern-monetary-system

Google "Takahashi Korekiyo."

ReplyDeleteThat pretty much answers the MMT issue, too.

Japan wont default! Not on your sweet life... Keep on Dreamin'

ReplyDeleteHow many of those defaults in your graph mostly stiffed foreign creditors?

ReplyDeleteIt strikes me that if the Japan government did default, given how much is owed to its domestic elderly the government would face massive pressures to compensate the elderly through pensions, or something, with limited gains overall (though on the other hand such a government funding scheme may be more redistributive than just paying the interest on debt, [although on the third hand, the morality of depriving elderly who brought government debt of their money in the hope of boosting elderly who brought shares, aka my gran at the expense of my grandma, is a bit uncomfortable too]).

The answer according to the liberal establishment and its fanboys such as the author:

ReplyDelete"Moar! Just print moar!"

(And import millions of Islamo-African immigrants)

Brilliant!

Don't forget Asians!

Deletehttp://www.theatlantic.com/business/archive/2012/10/the-secret-to-us-growth-in-the-21st-century-more-asians/263161/

neurofeedback for adhd

ReplyDeleteZengar.com is a Industry Leader in Home Neurofeedback, Neurocare, Neurofeedback, Neurofeedback Training, Neuroptimal, Brain Workout, Braintraining, Brain Exercises, Brain Fitness, Healthy Brain, Neural Plasticity and Neurotechnology.

Thanks for sharing this great article! That is very interesting I love reading and I am always searching for informative information like this.

ReplyDelete