The Federal Reserve's unprecedented programs of Quantitative Easing have not, as many predicted, resulted in substantially increased inflation. But I view this as a failure of the policy, not a success.

Inflation is grossly underappreciated. Economists consistently fail to educate the public about what they mean by the term "inflation". People think it just means "a rise in the price of something" (though that's not really what it means). And people don't like prices rising, because it seems like it should make stuff more expensive - and who wants that?

We're told that inflation is a necessary cost of improving the economy. And in fact, that's exactly what monetarist macroeconomists (think of Mike Woodford, Miles Kimball, etc.) tell us that it is. We must accept higher inflation, they tell us, in order to also get better GDP growth. But given our 'druthers, they tell us, we'd rather have very low inflation. No one wants to become like Zimbabwe, or the Weimar Republic, right??

I'm not so sure this is true, and I'll explain why later. But first, let me dispel a couple of popular myths about inflation.

Popular Inflation Myth 1: "Inflation means I can't buy as much stuff."

Wrong. Remember, inflation is an increase in the overall price level. But when the price of everything goes up, your wage should rise as well. Why? Because on average, we are all sellers of something. If you work in a tea shop and the price of tea goes up, your wage can be expected to go up as well, and so forth. Remember, every dollar that one person spends becomes the income of another person!

So when prices go up, wages should go up as well. Read this paper. The authors find that "higher prices lead to higher wage growth".

Of course, wages are affected by other things besides inflation - for example, labor's share of total income. So "price inflation" and "wage inflation" aren't exactly the same. But they tend to be similar:

(source.)

Economists have a term for how much you can buy with your wages. It's called the "real wage". Real wages are wages AFTER accounting for inflation. So to look at how much you can buy, don't look at inflation, look at your real wage. Your real wage tells you your real cost of living; inflation does not.

To see that inflation doesn't reduce your real wage, just think about Weimar Germany. Prices went up by a factor of one trillion. But people did not starve en masse as a result. Remember that guy with the wheelbarrow full of cash, going to buy bread? HOW DO YOU THINK HE GOT HIS HANDS ON A WHEELBARROW OF CASH IN THE FIRST PLACE? The answer: That was not his life's savings. He did not sell the family farm. He had a wheelbarrow full of cash because as prices skyrocketed, wages skyrocketed too!

"But don't employers take advantage of inflation to screw over workers and make them take wage cuts?"

Maybe. People don't pay close attention to inflation when it's low, and so a small amount of inflation can allow employers to cut real wages without people noticing. (Actually, some economists who want "wage flexibility" like a small amount of inflation for exactly this reason.)

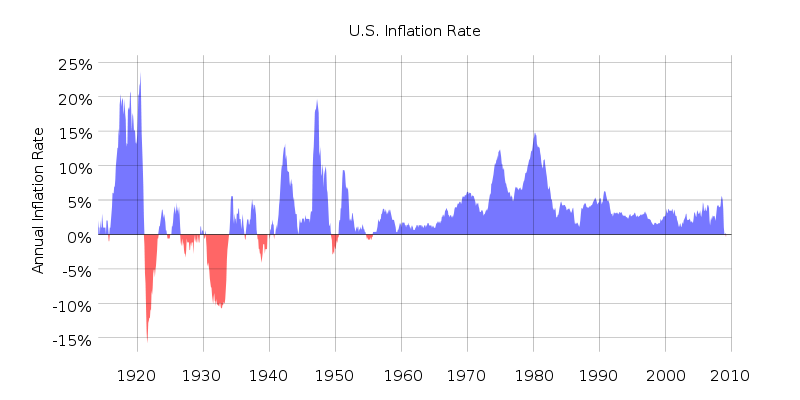

But for larger amounts of inflation, no. When inflation gets big, people start noticing, and demanding higher wages. See the paper I linked to earlier for proof. Also, check out historical U.S. inflation:

Check out those huge inflation spikes in the 1910s and 1940s! But workers got much richer in those decades.

Anyway, once more: Inflation does not make your real wage fall.

Popular Inflation Myth 2: "Inflation punishes savers."

This one is partly right. Surprise inflation punishes past savers, because inflation redistributes wealth from creditors (past savers) to debtors (past borrowers). But in the future, interest rates will adjust to take inflation into account. That's called the Fisher Equation:

So if inflation goes up (and if it's a surprise), future savers will be OK, because they will demand - and get - higher interest rates.

OK, so there are the popular myths. What about the benefits of inflation?

Inflation Benefit 1: Your debt goes away.

Chances are, if you're young and have a mortgage (and maybe some car loans too), you are almost certainly a net borrower. Even if you have some savings, they are probably outweighed by the mortgage. Which means that inflation makes you richer. Remember, surprise inflation helps debtors and hurts creditors. Who are debtors? Mostly the young and the poor. Who are creditors? Mostly the old and the rich.

Now you hopefully see why many conservatives don't like inflation!

Inflation Benefit 2: The federal government debt goes away.

All that scary federal government debt! Slows down economic growth, right? Well realize that when there's inflation, the value of the federal government's debt erodes, just like your mortgage! Debt stays the same in $ terms, but nominal GDP goes up, so the debt-to-GDP ratio goes down! That high inflation in the postwar era is exactly how we got rid of our huge World War 2 debt.

And remember that today's government debt is tomorrow's taxes. Inflation therefore reduces the size of your future taxes. Inflation is a future tax cut! Remember, inflation means the value of a U.S. dollar goes down. But the dollar value of the debt does not change. So inflation allows you to pay off your share of the government debt with "funny money"! Awesome, right?

Inflation Benefit 3 (?): "Balance sheet recession" might go away!

Lots of people believe that the U.S. and other rich countries are experiencing sluggish growth because they are still "deleveraging" - in other words, reducing their total stock of gross debt. Now, that's a controversial theory. But if it's true, it means that inflation would help America deleverage and get back on its feet faster. Essentially, inflation is a partial debt jubilee.

Now, I have to be fair, so I should mention that of course inflation has its costs as well. One of these is the pure nuisance cost - constantly changing prices is a nuisance, and that nuisance can become extremely economically damaging in a hyperinflation. Second, high inflation leads to variable inflation, increasing uncertainty and depressing investment. And finally there might even be government moral hazard; if the government decides it can simply inflate away its debt, it might engage in more irresponsible spending. These costs are all especially severe for higher levels of inflation.

But anyway I hope, after reading this, that you will be a little more wary of all those warnings about the evils of inflation. stop listening to poorly informed politicians, "Austrian" forum trolls, and your uncle who thinks he's still in the 70s. Inflation does not rob the poor man of his hard-earned wages; in fact, it is more likely to unburden the poor man from his crippling debt. And inflation helps get rid of all that debt, both public and private, that many people believe is clogging up our economic system.

We don't want to let inflation get out of hand. But a higher Fed inflation target for the next decade - say, 4% or 5%, instead of our current 2% - would probably be a good thing for most Americans.

Update: Finance blogger Mish Shedlock responds to this post with quite a bit of spluttering.

Noah,

ReplyDeleteyou forgot one more benefit of inflation, highlighted often by Steve Williamson, that inflation is a tax on those who hold currency, and those who hold large amounts of currency are usually illegal enterprises. Raise inflation, and you are taxing them more.

At the same time, you ignored all the costs, like:

-The cost of updating menus, catalogs, price tags, etc. more frequently

-The cost of taking more frequent trips to the ATM as holding currency becomes more costly.

-Costs arising from the misallocation of capital across sectors.

Of course, at 5% inflation maybe these costs are not significant enough, but I would like to have some quantitative evidence that the benefit exceeds the cost. Moreover, what would a 5% inflation do to creditors, like the holders of mortgage loans with 3% and 4% rates fixed for 30 years? Are you setting us up for another financial crisis? :p

At the same time, you ignored all the costs

DeleteHow can you say this when I have a section on costs???

-The cost of updating menus, catalogs, price tags, etc. more frequently

-The cost of taking more frequent trips to the ATM as holding currency becomes more costly.

I considered these to be included in "nuisance costs".

-Costs arising from the misallocation of capital across sectors.

This I'm not familiar with, but sounds interesting. What's a good paper on the topic?

Of course, at 5% inflation maybe these costs are not significant enough

Another point I made in the post! ;-)

Moreover, what would a 5% inflation do to creditors, like the holders of mortgage loans with 3% and 4% rates fixed for 30 years? Are you setting us up for another financial crisis?

Those creditors are also likely to be fairly highly leveraged. Inflation should attenuate their return but not flip it from positive to negative.

I have always been a little uncomfortable with that notion of "taxing."

DeleteYou'd be reducing the value of their cash holdings, not "taxing them" because you aren't getting the benefit of that loss of value.

As for the costs you mention, the first two are specific examples of nuisance costs. The third is just made up (by Mises or Hayek, I can never remember).

inflation is a tax. nothing - except for a discounted brand of energy drink- I buy at the Walmart is cheaper than it was just 2 years ago. Now we can re-define inflation to exclude ..umm...inflation. awesome

DeleteSo if inflation is a tax, what is an increase of wages for the same level and amount of work?

DeleteDid your wages go up from 2 years ago?

Noah, sorry, I meant you ignored all the costs BELOW. The word "below" never made it. But yes, I suppose the word nuisance may cover them. Anyway, we do agree that moderate inflation is not the monster some people make it to be, but I am not sure how benign it is.

DeleteOn capital and other distortions, see the following:

-Feldstein and Summers (1979), "Inflation and the Taxation of Capital Income in the Corporate Sector." published in the National Tax Journal (A 1978 NBER working paper version is also available) and Cooley and Hansen (1991) titled "The Welfare costs of moderate inflation" in the Journal of Money, Credit, and Banking.

-Frenkel and Mehrez (2000) in Economic Inquiry find that higher inflation induces a misallocation of resources from the production of consumption goods to the financial sector (which manages liquidity).

-Fisher (1981) in the Brookings Papers on Economic Activity and Ball and Romer (2003) in Journal of Money, Credit, and Banking show how, with asynchronous price adjustments, inflation results in relative price variability that also distorts the allocation of resources.

Thanks!!

DeleteDon't find any possible reason to cheer up with inflation going up the rates of general commodities is also increasing day by day.

DeleteThanks

William Martin

PPI Claims Made Simple

Possible extra benefit - easier to adjust prices? If you're in the widget industry and have a mortgage, and the widget industry has become uncompetitive, better to have two years below inflation wage increases rather than a wage cut.

ReplyDelete"So inflation allows you to pay off your share of the government debt with "funny money"! Awesome, right?"

ReplyDeleteYay! Free lunches for everyone!

“it might engage in more irresponsible spending”

Pfft. What are you? Some kind of backwards liquidationist?

Notice that I do mention the possibility of what you're talking about ("government moral hazard").

DeleteGDP growth 1-2% a year..yea we got a long way to go before that kicks in, although I agree the debt doesn't pose a thread to the economy.

DeleteDoesn't nominal inflation punish savers through taxes? With 0% inflation, you can maintain purchasing power indefinitely. At 10%, you have lose about 3% per year for example. You might argue that taxes are an orthogonal issue and that taxes could conceivably change to allow an inflation deduction or something like that except for point 2.

ReplyDeleteyes it is a tax. if gas & food is going up 10% a year your wages sure as hell wont be

DeleteInstitute:

DeleteWell, you might want to consider that you're poor at your job (or in the wrong industry) and are simply being saved from decreasing real wages by downward wage rigidity and corporate inertia.

Those of us who can get good wages on the open market aren't afraid of 10% inflation rates.

Dohsan.

DeleteCongratulation on currently able to get a good wage. Let us hope for your sake that continues. Look at the overall data and you will find the trend is for wages to lag price increases, significantly so in recent years. Are you saying that the vast majority of the workforce are poor at their jobs or in the wrong industry? Based on your perspective does this adjustment rest solely with the workforce?

Doshan,

DeleteI find your attitude quite irresponsible indeed, as pointed out by Anonymous above.

You might find my reply to Noah interesting anyhow. After all, if you got such a great job, putting you in the top 1% and you don't fear 10% inflation, surely you won't fear what I got to propose...

http://theredbanker.blogspot.com/2013/08/noahpinions-latest-on-loving-inflation.html

"So, in conclusion, I still dislike the idea of using inflation as a way to solve our debt issues. Inflation remains the silent thief. Making it the silent Robin Hood does not particularly entice it to me".

Frederic: So you prefer a debt-deflation spiral, debt overhang, and increasing inequality?

DeleteIf inflation is a thief, then what do you call a nominal wage increase for the same amount and level of work?

Anonymous above:

I looked at the overall data. Did you look at the overall data? Noah posted it above. I do not see a lag there. Certainly not in recent years. Just stating something doesn't make it true.

Doshan: Huh? I don't see how what I say can possibly interpreted as Austrian? :)

DeleteBut, to your second point, I would call it ad-hoc wage catch-up. Wages have been trailing productivity gains by an ever wider margin since the mid-late 70s, Labour share of GDP keeps getting smaller.

In an economy rightly based on consumption (rather than imperialism, say) then this fact cannot be good.

Frederic: What you seem to be implying is that there is an element of class warfare going on. Free market purists sometimes can't conceive of the possibility of imperfect markets and so never address the sources for why real wages track productivity and by implication inflation...

DeleteHi, Anonymous

DeleteTo be fair (and I acknowledge this in my blogpost), I am not sure how nominal wages track inflation so well... It could be correlation. Inflation went down and nominal wages slowed down for maybe joint reasons (imported deflation, for example, could explain both phenomenons) but, one, I have the sneaky feeling that inflation does not represent correctly the fact that important stuff like education, healthcare and (till recently) housing was getting more expensive way faster than nominal wages and, two, I am still not sure on how to reconcile this data that seems to suggest that things aren't so bad on the wage front with the fact that wages have been stagnating for the great majority of people.

As to your point about class warfare and imperfect markets, I am not sure I was consciously referring to this in my reasoning above but it is, imho, a fundamental problem in our economic set-up. So maybe my views seep through? :)

Well, I always thought that you could kill several birds with one stone through inflation and I was wondering why so few people agreed with me, so thanks for confirming my attitude. I think the 2% inflation target is too low. Because of this, inequality is too high, growth is too low, debt is too high and we're always close to the zero lower bound.

ReplyDeleteThose menu costs should decrease significantly in the digital age.

I object to being called a troll simply because I adhere to the Austrian school of economic thought. Inflation is like heroin. A little bit feels good and then becomes addictive. But after a while, there are only two choices: withdrawal or overdose. Withdrawal is the healthier, albeit initially painful and difficult option. Overdose is the hedonistic, less responsible choice, and results in the death of the user's entire system.

ReplyDeleteRight now, the U.S. is a fairly heavy user. Recognizing this, it's thinking about scaling back on the dosage a bit next month, just to see how it feels. If it's not so bad, maybe they'll eventually get clean and stop using completely. My guess is that it won't feel very good, and it'll choose to up the dosage again after that. Or maybe it'll decide not to scale back at all. We'll have to wait and see.

Ah yes, in generating 1.2% inflation per annum, the Federal Reserve is no different than that heroin dealer in Pulp Fiction.

DeleteHey Brother, A heroin user can appear quite healthy for a while after he starts using, and the symptoms that he exhibits may be minimal. He might even seem like a real cool cat.

DeleteThink of small inflation as a offering to the Roman Gods, ok? So Uncle Sam gets to write off debt bit by bit. Would we deny him that? On the other hand focus on the hugely productive assets that Uncle Sam produced and produces: Highway systems, B2 bombers, Internet, Tenessee Valley Authority, National Science Foundation. DoD research.....like I said focus on positive NPV assts and keep those assets productive.

DeleteAnd don't sweat the small stuff like BIG DEBT and BAD INFLATION.

B2 Bombers are hugely productive assets? I always thought they were highly destructive. The NSF is hugely productive? We are obviously on the opposite sides of the economic spectrum when it comes to analyzing productive assets and organizations. The internet is produced by Uncle Sam? Really?

DeleteOk B2 bombers we can have a separate discussion (it kind of gets a bit touchy), Highways? ANd yes the Internet was a product of the DoD (it was called TARPA NET. YOu need to wake up and do some actual digging around!)

DeleteNSF?

Man check out the past, present and future discoveries and projects. Literally everything you take for granted is here. And not produced by John Galt!

http://www.nsf.gov/discoveries/index.jsp?prio_area=5

Sorry meant to type DARPA instead of TARPA (I have too much of the financial crises in my head! :-)

DeleteIf you have a "school" of economic thought, why are you offering over-wrought and obviously hyperbolic analogies?

DeleteYeah it is the school of economic thought called facts.

DeleteWhere do you see hyperbolas?

Much better than getting my economics from reading Atlas Shrugged.

This comment has been removed by the author.

DeleteSom Dasgupta - I think you took my response to Neil as a response to you.

DeleteYes I figured with a slight lag. Apologies!

DeleteSimpler: total spending equals total income. You can't increase one without increasing the other.

ReplyDeleteThere are, of course, distributional issues.

Also, higher inflation means higher interest rates gives the Fed more room to act. It can't cut nominal rates at the zero lower bound.

"Inflation Benefit 1: Your debt goes away.

ReplyDeleteChances are, if you're young and have a mortgage (and maybe some car loans too), you have a negative net wealth. You are a net borrower. Even if you have some savings, they are probably outweighed by the mortgage. Which means that inflation makes you richer. Remember, surprise inflation helps debtors and hurts creditors. Who are debtors? Mostly the young and the poor. Who are creditors? Mostly the old and the rich.

Now you hopefully see why many conservatives don't like inflation!"

Assuming certain definitions that may or may not be correct, does not have to be. Prices go up. Wages do not go up enough. That can make it harder to make interest and principal payments.

Wages are a price, anon. If they're not going up but prices of goods are going up, then that's not inflation. It also doesn't happen - notice the blue line on Noah's graph is always above zero.

Delete"Wrong. Remember, inflation is an increase in the overall price level. But when the price of everything goes up, your wage should rise as well. Why? Because on average, we are all sellers of something. If you work in a tea shop and the price of tea goes up, your wage can be expected to go up as well, and so forth. Remember, every dollar that one person spends becomes the income of another person!

DeleteSo when prices go up, wages should go up as well. Read this paper. The authors find that "higher prices lead to higher wage growth".

Of course, wages are affected by other things besides inflation - for example, labor's share of total income. So "price inflation" and "wage inflation" aren't exactly the same. But they tend to be similar:"

And, "We don't want to let inflation get out of hand. But a higher Fed inflation target for the next decade - say, 4% or 5%, instead of our current 2% - would probably be a good thing for most Americans."

Sure sounds like Noah and most economists mean goods/service price inflation and not wage inflation when they say inflation. The best idea is to not use the term inflaton by itself period. I also see places where the blue line is below the dark red line. It's called negative real earnings growth.

Noah, Noah, Noah (sad shaking of head). As a relatively old, relatively rich guy I'm in the "inflation is theft" camp.

ReplyDeleteFirst you say expected inflation does not punish savers (because they demand higher nominal returns) and then you say that inflation benefits borrowers. But the only inflation that will benefit borrowers is unexpected inflation. Inflation "works" only by: getting around downward "stickiness" and wrong footing investors.

Inflation can have some other consequences: higher nominal rates can put a cash flow squeeze on households; higher nominal rates on corporate debt is deductible from income for tax purposes reducing the effective real cost of debt; taxation of income from nominal interest rates drives investment to tax exempt structures like pension plans, endowments, 401(k), etc.

Are you being forced to hold fixed-income assets...?

DeleteNo, but I am being forced to hold assets outside of 401(k) plans so some of my gains are nominal gains that get taxed.

DeleteIf all investors chose to avoid fixed income assets because of Noah's inflation then it is hard to see how young borrowers would benefit.

That's true, someone has to lend, presumably a fixed-income asset, for the borrowers to benefit from inflation. Still, your portfolio should have hedges that make up any loss. Seems to me that inflation is a win-win...

DeleteStill, your portfolio should have hedges that make up any loss.

DeleteI am open to suggestions but it seems to me that any sort of hedge or insurance on my portfolio would have costs.

Also, if you have an ARM on your house and inflation goes way up, you're screwed.

ReplyDeleteand/or a teaser rate also?

Delete"Also, if you have an ARM on your house, you're screwed."

DeleteFTFY

On wage inflation: I thought keynesian models had sticky wages causing unemployment. Inflation is supposed to help reduce nominal wages. But if wages go up with inflation then monetary policy causing inflation to go up cannot help with unemployment.

ReplyDeleteAm I missing something?

Som Dasgupta,

ReplyDelete"However, Noah's basic argument is correct."

I didn't disagree with it. As I said (way above, my browser doesn't do "reply"): "Either way though, with real assets and nominal debts, you are definitely long surprise inflation." I was just making a "minor" correction.

Got it

DeleteYes, K, you're right. I changed the original post. In the interests of not confusing people I deleted your original comment, but yes, you were right! I meant to write that people have net short positions in nominal debt.

DeleteIt seems to me you deleted the comment because you got the accounting wrong. Not unusual for economists.

DeleteI wonder why some countries get super-inflation worse than others. Ruchi Sharma made a point a while back about how Brazil would get rapidly rising inflation even on relatively modest levels of nominal GDP growth, whereas China and the other East Asian countries got pretty solid growth without double-digit inflation.

ReplyDeleteOK so I concur with Keynes:

ReplyDelete"By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens."

But with such a large debt overhang and with a direct debt jubilee politically very difficult and liquidationism extremely dangerous, there seems to be no safe alternative to a higher degree of inflation to make the nominal private debt load more manageable.

So inflation is good theft. Inflation is like Robin Hood.

DeleteBut isn't it also true that low, steady inflation is a safety net protecting an economy from slides into deflation (which most would agree is far worse)?

2% is the Fed's buffer against deflation, as well lubricating the economy a little by devaluing past debts. This seems like the right figure in the long run, but in the next 10 years with the private debt load so high, 4% would be a fairer target. Of course, whether the Fed can actually hit 4% right now is another matter entirely.

Deletethere seems to be no safe alternative to a higher degree of inflation to make the nominal private debt load more manageable.

DeleteInflation rewards all borrowers, regardless of need, and punishes all savers foolish enough to have lent out their money long term. There is no reason to come to the aid of all borrowers. If you want targeted relief then reform the bankruptcy laws - that would benefit the most needy borrowers and lay the cost on the imprudent lenders. That should have been done for mortgages in 2008.

One of the consequences of people saying the things that you are saying is that people like me are sitting on our cash and not spending or investing in productive assets.

By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.

DeleteYes, but it automatically transfers that wealth, secretly and unobserved, to a different group of citizens.

Yes, but it automatically transfers that wealth, secretly and unobserved, to a different group of citizens.

DeleteSome of the winners will be richer and less deserving than some of the losers.

"less deserving"

DeleteYou're opening Pandora's Box with a line like that! :P It seems to me that no matter the proposition in macroeconomics, the debate always boils down to Social Choice. Too many theories have *oughts* in them.

Remember that there is no such thing as "redistribution." There are only different distributions.

DeleteBrett,

ReplyDelete"I wonder why some countries get super-inflation worse than others."

It's just a choice. In developing economies 1) the distorting effects of inflation risk may be lower because capital investments are shorter and 2) other forms of taxation (income, property, etc) may be difficult or impossible to implement. So inflation becomes a relatively more efficient way to raise revenue. I think that's the consensus understanding of why developing countries run higher inflation than developed ones.

There's a fairly big literature on the cost of inflation in terms of growth, and the estimates seem to be that for developing economies you start to get an impact somewhere between 7-15% (IIRC). I don't know anything about the specific trade offs in Brazil vs China, but no doubt, any developing country could run whatever inflation rate it wants to.

Coincidentally, I just wrote a Myths of inflation posts a few days ago:

ReplyDeletehttp://bessiambre.tumblr.com/post/58338607070/misconceptions-about-money-creation-and-inflation

(I am not an economist and my tumbler is more or less just a way of consolidating some thoughts)

I make similar points to the ones in this post.

I will say that the two first benefits of inflation you mention, government and private debt being partly reduced, are not considered benefits by everyone. It can seem like a free lunch and unfair to lenders.

However, in the context of a liquidity trap where market rates are distorted up, it can be justifiable to create a bit of inflation to let the real rates go down to their true free market "natural" levels. Otherwise it is lenders and cash hoarders who are getting the free lunch when the rates aren't able to go down enough to reach free market levels.

Popular Inflation Myth 1: "Inflation means I can't buy as much stuff."

ReplyDeleteNow we can re-define inflation to exclude ..umm...inflation. Wages goiong up? don't count on it

How did the guy get the wheelbarrow full of cash in the first place?

DeleteIt's pretty hard for the overall price level - not prices of specific individual products - to go up without wages also going up. That's because wages are a significant production cost and because you can't sell your stuff for more if people don't have more money to buy it.

DeleteAnd by the time he got his wheelbarrow full of cash to the bread shop it was highly likely the price increased by 100%.

DeleteAlso, what about the unemployed and those on fixed incomes? How is inflation good for them?

And finally, what is worng with deflation, why would people have a problem with falling prices?

Here’s how I’ve thought of it in previous comments:

ReplyDeleteWith regard to low inflation targets, like our 2%, I've lately started thinking of the analogy of standing really close to a very dangerous and deep pit, like just 2 feet (or 2 percent) away. It's pretty easy for a tremor or other disturbance to make you fall in, get hurt severely, and have it take a long time before you can climb out.

So, as the cost is not that high to stand further away, like 4 or 5 feet (or percent), isn't that the smart, preventative medicine, thing to do?

It's widely acknowledged how dangerous the ZLB is, yet your target is to stand super close to it, so it's easy to fall into it?

Also, Slipperyslopeaphobia:

http://richardhserlin.blogspot.com/2008/07/slipperyslopeaphobia.html

Let me be an annoying pedant:

ReplyDeleteYou cannot claim that inflation decreases taxes and future debt directly (NGDP), while also assuming that the fisher equation hold true unless you assume that the government doesn't roll-over the debt. If it does the higher inflation will increase the interest rates through the Fischer equation, right? Having to pay higher interest rates can actually make the debt situation worse.

For that to happen inflation must increase RGDP as well, which is I think is pretty important.

Another cool thing about inflation - it may increase the taxes you pay by moving you into a higher bracket; but that is conditional if the brackets are setup numerically "income above $n pays m%". A lot of jurisdictions just index the taxes using the minimum wage, which is increased regularly. That is assuming progressive taxation, of course. It may happen that the system you live in is creatively regressive though!

You cannot claim that inflation decreases taxes and future debt directly (NGDP), while also assuming that the fisher equation hold true unless you assume that the government doesn't roll-over the debt. If it does the higher inflation will increase the interest rates through the Fischer equation, right? Having to pay higher interest rates can actually make the debt situation worse.

DeleteCorrect. The government's short-term debt does not decrease, but it's long-term debt decreases. Our government has a lot of long-term debt.

Sure, but doesn't the government have to roll over the long-term debt as well?

DeleteI can see that its easier to pay interest on a 30-year bond, when starting from the 2 year you have much more inflation, but the next time you try to issue 30 year-old bonds you'll get higher interest rates (assuming things of course).

Sure, but doesn't the government have to roll over the long-term debt as well?

DeleteEventually. Some of it is coming due immediately, and some isn't coming due for a while.

Check out that example of WW2 debt.

WW2 debt-to-gdp was reduced because of real GDP growth. If anything the biggest reductions in debt were in the low-inflation 50s and 60s.

DeleteNow, if the 50s and 60s CB were extreme inflation hawks, I doubt this would have happened. (Just like inflation hawk nations like New Zealand, Canada and Germany have grown less than dovish nations like the United States and Australia )

WW2 debt-to-gdp was reduced because of real GDP growth.

DeleteThat was important too, of course.

Dimitar, how about actually reading that Menzie Chinn paper I linked to? ;-)

Thanks, I will look at the cited results, it is interesting. But I still think that inflation can work both ways on debt servicing.

DeleteI have nothing against higher inflation in EU, US and Japan, now of course.

A day of very low probability: I have absolutely no disagreement at all with an apparently controversial Noah Smith post.

ReplyDeleteWow I hate to pull the Scott Sumner card here, but this whole discussion is a classic case of everybody getting confused about inflation because it's such a poorly defined and poorly explained-by-economists concept. Somebody mentions the I-word on the internet and in no time everybody's talking every which way about good vs bad inflation, real interest rates, gold, Wiemar Germany, theft, punishing savers, etc. etc. etc.

ReplyDeleteAt the end of the day it vastly clarifies the issue to use NGDP as your demand measure and the AS-AD model to determine the split between inflation and RGDP for a given level of NGDP growth.

To use just one example, unexpected inflation does NOT benefit net borrowers. Unexpected NGDP growth does, as the borrower's debts are denominated in nominal dollars, and thus nominal income is what measures his ability to service debt. If inflation unexpectedly jumps to 4% due to a supply shock, but the Fed keeps NGDP growth on hold at 5%, then RGDP growth winds up being 1%. In that case inflation has done nothing to help or hurt the borrower's ability to repay the debt.

Trying to explain inflation and all its nuances to even relatively economically literate people has proven to be such a hopeless task that NGDP and AS-AD winds up being better in almost all respects.

Wow I hate to pull the Scott Sumner card here, but this whole discussion is a classic case of everybody getting confused about inflation because it's such a poorly defined and poorly explained-by-economists concept. Somebody mentions the I-word on the internet and in no time everybody's talking every which way about good vs bad inflation, real interest rates, gold, Wiemar Germany, theft, punishing savers, etc. etc. etc.

DeleteYep.

At the end of the day it vastly clarifies the issue to use NGDP as your demand measure and the AS-AD model to determine the split between inflation and RGDP for a given level of NGDP growth.

It clarifies the issue but it requires you to commit to a model, thus sacrificing mental and analytical flexibility.

"It clarifies the issue but it requires you to commit to a model, thus sacrificing mental and analytical flexibility."

DeleteWell, this blog post is presented as a "debunking popular myths about inflation" type post, so I would say clarity to your average Joe should be one of the most important factors when deciding how to present your material. Additionally, I'm not so sure you need to commit to a model here. Just about everything you say in your post about inflation applies equally well if not better using NGDP (e.g. my helping net borrowers comment above), mostly independent of model choice. The question of what causes shifts in NGDP and what causes the SRAS curve to be shaped the way it is are largely irrelevant for purposes of your post.

Excuse me but I don't see your point.

DeleteYou give an example of inflation jumping to 4%, RGDP going down to 1% and stating that this does nothing to help/hinder borrowers...

Well, hold on. If I got nominal $ debt, 4% inflation helps. Period. If that inflation happens to happen during a stagflation, my debt load getting a bit smaller might not be my main concern (losing my income might) but that's besides the point.

Basically, I think inflation is quite clear a concept. We can argue about sectorial inflation inasmuch as I disagree with Noah on the fact that saying 'asset X' or even wage-inflation are fairly clear and understandable narrowing of the term. But I get his counter-arguments. Yours. not so much...

Wage increases always lag inflation so the common man always loses. Inflation is a game where those at the lower rungs always lag behind inflation so see the smallest potential benefit (if any), and eat we eat the price increase with a lagging wage increase that rarely matches inflation.

ReplyDeleteIf inflation is 10% do you think we all will get a 10% raise... um sure... Wage appreciation rarely matches real inflation, again many of us lose. With a depressed job market the downward pressure on wage appreciation means that net spending power is diminishing over time. Just like compound interest, compound lag and gap have been very efficient at subtly destroying the net purchasing power of folks.

With how the job market really is workers are the last in line to see any possible benefit. A weak labour market means wages for most folks are dropping, especially when you take in flat or dropping wage but not flat inflation. Even if inflation was high due to the depressed job market wage appreciation would not match inflation for the bulk of the populace, as it going on right now. Wage increases in a time of oversupply are as rare as Republicans that support socialized medicine. The current situation has been a great opportunity to further erode the share common men get of the pie.

Sorry Noah, I am not buying this one, it ignores the lag and gaps that occur that compound over time. I think you looked at the macro level but forgot the over time effect on most people at the person level.

Over history, real wage gains have been (slightly) positively correlated with inflation. What do you think about that?

Deleteagree. I've been reading these 'no inflation' arugments since the bailout and while there is technically no inflation according to the bond market, there is in a lot of other areas such as stuff that people actually need. maybe if you have a plush tenure like krugman with full benefits you aren't going to be impacted by rising living expenses, but many middle/lower income folks and independent contractors are.

Deleterising living expenses

DeleteBut inflation does not mean rising living expenses.

Are you considering the lag and its effect on disposable income? It is like compound interest in reverse. The period during the lag in wage increase compared to price increases due inflation is a loss of spending power for workers. What workers are paid versus inflation is always a catch up game, where the workers almost always lag. That lag, cumulatively is what hurts workers, possibly more than what they gain in increases.

DeleteI understand inflation in and of itself is not a bad thing. Unfortunately the job market is not synchronized to it, so the workers lose out in the catchup period between increasing prices and subsequent (hopefully) wage increases.

OK, so define "inflation" as "wage inflation". Now there's no lag. Voila!

Delete...oh wait, that can't make sense...hmm...how is this more complicated?

Inflation results in continued adjustment to "equilibrium", those adjustments are not simultaneous, the time gap leads to profit and corresponding lose during the adjustment period. Workers usually end up in the losing group especially if you look at the how often wage adjustments lag other adjustments. I have a hard time seeing wages leading except in rare exceptions with limited scale. If they force up the minimum wage we will have some very good data to quantify wages leading the adjustments. I guess I am over focused on the impact to people rather than the economy as a whole.

DeleteJust some links showing how real wages lag inflation:

Deletehttp://www.epi.org/blog/real-hourly-wage-growth-last-generation/

http://www.nytimes.com/2013/01/13/sunday-review/americas-productivity-climbs-but-wages-stagnate.html?_r=0&gwh=93ED324DC9346914D01B25C37F93C105

http://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/documents/publication/wcms_194844.pdf

Inflation is not a bad thing, but badly lagging wages seem to be a cruel way it plays out to working people.

There is already a high inflation in prices: fewer and fewer items go on sale. Go to Home Depot and you will notice the area in front of the cashiers is nearly empty. It used to carry lots of stuff on sale. It is the same at every retail store. You can sell less quantity at higher price and still meet revenue targets. You can also let go lots of people because you do not have to stock and display lots of stuff. This also creates a big pressure on jobs and wages; low and mid level jobs are taking pay cuts. And, many of these guys and gals are not able to save or plan for retirement.

ReplyDeleteFor the rich, it is totally different story. Their pay/incomes have been going up and their taxes are going down.

What I would like to see wage inflation, price deflation, and, significant increase in demand.

If there is one thing everyone should agree on it is that it is impossible for you to observe inflation personally. Even if you were capable of keeping track of all that data, we are all severely compromised by confirmation bias and the disproportionate strength of the impression of a higher price over a lower one.

DeleteSo, no, don't go to Home Depot to find out what's happening with inflation. Look at the data.

Wow! If Noah (who I've long considered too conservative to be worth reading regularly) keeps this up, I'll become a regular reader! I'm shocked, but it seems to me he has presented an even better and broader defense of inflation than Steve Randy Waldmann, one of my favorite bloggers.

ReplyDeleteSomeday we might actually be thinking about utility generally, and not simply what makes rich people feel more secure. I'm not sure why people think that preserving the value of simple savings is one of the highest social goals. Surely job 1 is getting a good job for everyone, and there is enormous evidence that inflation and job growth go hand in hand, late 1970's for example. IIRC more private jobs created during the Carter administration than any other.

What leads to hyperinflation Zimbabwe style is collapse in production, which is exactly the kind of thing that can and will happen if VSP's are too focused on the wrong things...like inflation.

Too many Keynesians are focused on the wrong stuff. Throwing money, whether it be "deficit spending" from people like Summers, or "targeted (federal) capital investment" from people like Stiglitz, show a sore ignorance of political economy. Government spending is already high, and most money just gets transferred, not invested in infrastructure.

Delete@Yeah: I hope you understand that transfers are not included in spending, as measured. Transfers are 'negative taxes.'

DeleteLet me troll the trolls:

ReplyDeleteHousehold appliances in Sweden: http://research.stlouisfed.org/fred2/series/CP0530SEM086NEST

-13%!!!!

Now, if I were a fridge-salesman in Sweden I would complain how falling prices are destroying my business, right?

Government is obviously lying about the other statistics. Other things like washers also have falling prices! Obviously as a fridge-salesman in Sweden I don't anything else to convince me that extreme deflation is a great threat to the Swedish and World economy!

Too bad a middle income family couldn't enjoy a 13% discount for one year on health expenses. But what if the breadwinner is a Business Analyst at a health insurance company? HORROR! JOB LOSS!

DeleteIgnores the other distributional implications of inflation which is the reason it is not popular:

ReplyDeletehttp://fixingtheeconomists.wordpress.com/2013/08/21/inflation-and-income-distribution-a-reply-to-the-vulgar-keynesian-policy-enthusiasts/

The "inflationist" argument is a political non-starter.

Worth mentioning that there isn't a single measure of inflation across the whole economy. I suspect certain constituencies are more affected by and thus more responsive to price changes in different sectors.

ReplyDeleteI think what many people commenting here don't understand (and correct me if I'm wrong) is the mechanism by which inflation may raise prices.

ReplyDeletePeople take raising prices and inflation as one in the same which is false. If lets say money supply increases and prices go up, I would counter this happens because people now have more money to spend on goods and thus increased demand drives up prices. But FIRST people have to be in posetion of this new level of money in order to consider spending it.

Inflation stats are really only helpful to two groups of people, and people who watch those two groups; People who do monetary policy, and the Treasury. We have a weird disconnect now, where Economists claim "low inflation," which is true, on average, but people, especially middle income earners, are facing large price increases in areas of health, education, and food.

DeleteThe mainstream economist consensus of deficit spending I think is simply wrong. Most federal government spending is income transfer, not on programs for infrastructure. There is no need to spend more; US citizens are not willing to pay more, the deficit is too high, the debt is too high, and total government spending is about 42% of GDP, enough in my opinion. There is a need to move money around to capital investment, no subsidizing ag. or special parties.

Your limit of 42% seems highly arbitrary and I think misses the point of government spending entirely.

DeleteYes I would agree that most government spending is a transfer of wealth or reasources but why is this undesirable?

If global economic forces and technology have been the main culprits of increasing income/wealth inquality (which is a popular conservative/libertarian argument) why is it inherantly wrong for a government thru consent of the people to counteract these measures via wealth transfers to maintain a level of equality we as a society find desirable?

Generally speaking, my view on government spending, is as local as possible, and were people can't or aren't willing to use market forces, to get goods/services collectively. Centralization of spending creates disconnects, where the citizens will individually is not enacted collectively.

DeleteThe problem with "increasing wealth inequality" is the assumptions in the data itself. It is not an accident, in the US, at the time of 91% marginal income brackets, that inequality was squeezed out, but only because of tax evasion, tax shelters, etc.

The plain fact is that the people do NOT consent to the levels of government spending, and the forms they are taking, that is the problem, but everybody likes everybody elses money. The irony here is that most economists on the left are pushing for "infrastructure spending," basically supply side government spending. My position is we don't need to spend any more money, we just need to reallocate.

Wage Inflation Fairy, come raise my wage! Some economists saidthat you magically come in the night and transfer newly-created money from Wall Street to wage earners...

ReplyDeleteBy the way the Fisher Equation is bogus given the Fed's control of rates. The QE Equation is

ReplyDeletei = r +pi - QE

So Saver Granny (or as a previous poster accused her of, Drug Dealer Granny) does get screwed by inflation thanks to the Fed.

Why is 'saver granny' hiding her money in her mattress? If she were to seek productive investments, she'd be fine. We ought to tax the hell out of 'mattress money.'

DeleteI have come to the conclusion that the BLS inflation statistics are skewed downwards for low, middle, and high middle income earners. Why? Three major areas that eat a large portion of these groups income due to price increases: College, health insurance AND health care, food and sometimes gasoline. The baskets don't accurately account for these expenses, and the federal subsidies in all cases are probably making the situation worse by perversing incentives (ie getting a college major that is not in demand, corn in places where it shouldn't be).

ReplyDeleteWould it be possible to have inflation states based on income? Rather than an "average" rate?

nice post here

ReplyDeletei also love your style of blogging here on noahpinionblog.blogspot.com :)

you see, there are 2 blogs that i've found so far to be very helpful and have something interesting for me whenever i visit, this one and http://danieluyi.com

Keep it up. I will be visiting again.

The author shows what is wrong with economists (esp. Keyensians). They live in a fairy-tale land where equations based on phony assumptions take the place of common sense. Please name the country/era in which high inflation has not been politically and socially destabilizing? Here's the real world: The German inflation that the author minimizes brought down the Weimar government and led to the rise of Nazi Germany. That's the real world. BTW, you actually have no idea if the money in that wheelbarrow was that person's life savings or not.

ReplyDelete"Who are creditors? Mostly the old and the rich."

ReplyDeleteNot true. Although almost by definition a net holder of nominal claims cannot be described as "poor", the less well-off (eg the old and financially unsophisticated) do tend to hold a larger proportion of their wealth in nominal claims, especially bank accounts.

But I would also question whether inflation benefits debtors (and cheats creditors) in general anyway. That is because, not least in view of the fact that the state tends to among the beneficiaries, further inflation is anticipated and factored into interest rates. So the effect of surprise inflation is to benefit today's creditors at the expense of tomorrow's creditors.

And let's be honest, that is the real motive of most inflationists; not the lubricating or deflation trap avoiding purposes - 2% is enough for that. The call for higher inflation (including engineered by NGDPLT) is just another way of kicking the can down the road a bit further.

Popular Inflation Myth 2: "Inflation punishes savers."

ReplyDeleteIf this is (partially) a myth, ie, future savers are not harmed, by implication, future borrowers don't benefit either. Thus, when you say

Inflation Benefit 1: Your debt goes away.

or

Inflation Benefit 2: The federal government debt goes away.

or

Inflation Benefit 3 (?): "Balance sheet recession" might go away!

these are also only partially correct; in that, once the inflation expectation is settled, none of these benefits will materialize. The past govt debt will decrease initially, but without a change of behavior, the interest rates would go up, and the debt servicing cost.

"Who are creditors? Mostly the old and the rich.

ReplyDeleteNow you hopefully see why many conservatives don't like inflation!"

Oh, so it's ok if the retirement savings of those who are in (or near) retirement are wiped out? Thanks for pointing that out.

Of course, most of these people aren't rich. (They also aren't necessarily conservative). We ARE people who have followed the standard advice of financial advisers and have allocated a large share of their investment portfolios to "safe" investments like Treasury securities. Well, "safe" only to the extent that idiots like you aren't in control of monetary policy, in which case you will have to stand by helplessly as the value of your retirement portfolios are destroyed by inflation.

Many such people also are on fixed incomes (e.g., pensions that don't adjust to inflation). They, too, will be wiped out.

So, please, stop pretending that this is an "old and rich" versus "young and poor" issue.

Dude, Noah,

ReplyDeleteSome of your blog posts are interesting to read. But, this was not "going out on a high note" before taking your break.

It was basically lots of reasons why inflation is good or not as bad, and then a paragraph giving passing recognition of its costs. And then it ends by simply calls people names if they happen to disagree. This leads to absolutely nothing constructive because it does not advance the debate forward and it immediately goes on the offensive since some people might disagree with you.

Those last three paragraphs turn it into the format of "here's what I think and those who disagree are dummies." I have yet to see any serious writer make any lasting difference using that formula. It weakens the argument and takes it down to Jerry Springer's level.

"today's government debt is tomorrow's taxes"

ReplyDeleteNoah has declared that it is so, so it must be true.

No evidence or argument is needed. Simply state something, Noah, and it is true, right?

After all, everyone *knows* it's true. It's just "common sense", right?

Why not try to substantiate your arguments instead of just stating things as if they were a given?

In what weird intellectual funhouse is that statement not true? If the government decided to fully pay off the debt next year, by what mechanism would it do that? I think the real question is 'why does Noah's stated accounting identity bend you so far out of shape?' If you think the identity is wrong, what do you propose instead?

DeleteThere is actually another cost associated with inflation: it increases the real cost of providing interest free credit between firms (e.g. in the form of 30 day payment terms), which is an important tool for businesses seeking to manage their cash flow.

ReplyDeleteI’m not an economist but I can make the observation that Australia’s higher and more flexible inflation target hasn’t seen it’s growth lag behind the US or Europe. Australia hasn’t had a recession for more than two decades and for the bulk of that time, as I understand it, the Reserve Bank has been tasked with keeping core inflation between 2% and 3% on average over the course of the business cycle, a task I think it has achieved.

ReplyDeleteDuring that time the RBA has been content to let inflation track towards the top of that range for long periods, unlike the Fed and the ECB who have seemed to treat their more fixed 2% targets as upper limits if you believe the liberal economics blogosphere. Inflation in Oz once got away a little, just before the financial crisis, but it was brought back under control without recession. Flexibility may have helped here – the RBA could look through the inflation that resulted when Australia’s currency plunged and keep slashing rates.